How to Train to Teach Pilates: Your Starter’s Guide

How to Train to Teach Pilates: Your Starter’s Guide Are you passionate about Pilates and ready to turn your love for movement into a meaningful

After the exciting weekend with the Fitpro convention

its onto Los Angeles for World Fitness Idea.

Ive been in town a few days and as Im writing this newsletter to you

Im listening to Kim Schwabenbauer who is giving a talk called

Eating For Life: The changing needs of the female diet.

Its really informative with a lot of great take away and

useable information & advice.

Its pre convention today so I have a full 3 days ahead

packed with classes and lectures which I am so excited about.

Ive also been to visit Hollywood studios & X Fit Boxes and as always

gets more fired up to want to open my open studio.

There are so many exciting gyms and studios offering

all kinds of awesome classes. Its all very inspiring.

Here are a couple of little clips and blogs from my time so far

in LA

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

YOUR BEST YOU – THE MAP IS NOT THE TERRITORY By Greg Sellar

I love this saying. It’s my phrase of the year so far as it explains (to me anyway) almost all the problems in the world people face with themselves and one another. It certainly goes much of the way in explaining why I might have differing opinions, values and beliefs to some around me and why we perceive things so differently. It’s the sole reason I might encounter conflict in my life (as much as I try and avoid it!).

The saying comes from the father of general semantics, Alfred Korzybski and it refers to our own perception of reality not being reality itself, but our version of it. It is our ‘map’ and not necessarily the ‘territory’.

We all experience things in life differently and it’s these experiences that form our map of the world. No two people will have the same map based on their family upbringing, socio-economic backgrounds, external environments and friends. We need to recognise that our maps aren’t really what’s going on in the world around us, but merely reflections of how we see life based on our past.

How many times have you said to yourself, “I just don’t understand why they behave that way / said that / did that / reacted like that / etc.” It’s because your values and beliefs come from your own individual map of the world and so do theirs’. That’s why it’s important to try to seek clarification and to aim to “see the world through their eyes”.

Where do these values and beliefs come from? We’re pretty much formed in our thinking patterns by age six or seven. In adulthood, most head-trash we carry with us has been imprinted by our parents in the early developmental stages of childhood. They will have shaped our thoughts and feelings towards much of what we experience in life and as no two sets of parents are the same, you can reasonably expect that no product of those environments will share exactly the same thinking.

As a result, it’s a good idea when approaching people in situations to remember:

• when we translate our experience into words, we remember it’s only a partial reflection

• we can confuse others when we mistakenly assume they share our assumptions and we leave vital information out

• we can misunderstand others when we fill in the gaps from our map of reality and not theirs

• we may share the same language, but may not share the same experience.

Whether it’s at work, in a relationship, related to body image or regarding family, remembering that the map is not the territory can be a lifesaver. It saves heart-ache, immense frustration and can lead to genuine resolution and flourishing.

For more information, sign up to Greg’s newsletter at GREGSELLAR.COM or Like GREGSELLAR.COM on Facebook.

Come and join us at Derby 25th July and listen to Gregs amazing knowledge. This is a one time only event with Greg who he over

from Australia DONT miss out.

Click here to book onto the day

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Have YOU Taken The Blue or Red Pill?

By Jo De Rosa

I’ve not been abroad for nearly a year and a lot has changed in that time, meaning I am a different person.

The more I meditate and keep that connection all through the day, the more I change internally forging new beliefs about myself and the world.

The ultimate effect of this inner work is seeing how my outer world is changing also.

I have always been a sun worshipper!! Literally from the moment off the plane to stepping back on it I’m out there catching every last possible ray. And I’ve never questioned it. Just accepted that I HAD to do that.

My red-haired dad has always laughed at me and loves to recount tales of me:

Burning, blistering, peeling, repeat

Burning, blistering, peeling, repeat

Burning, blistering, peeling, repeat

Burning, blistering, peeling, repeat

My parents have lived in Spain for 19 years and never sit directly in the sun, and when I look back to my years living in Thailand I never did either. So again I wonder WHY do it at all?

The Spanish and the Thai’s hide from the sun, in fact in many Asian countries they use whitening lotion on their skin. Yet I have always:

Burnt, blistered, peeled, repeat

Burnt, blistered, peeled, repeat

Burnt, blistered, peeled, repeat

Burnt, blistered, peeled, repeat

Which Pill Have You Taken?

We watched The Matrix again recently and chuckled as some of what Morpheus was saying is exactly what I also talk about when teaching!!

Dom and I have definitely taken the RED pill!

We live in the middle of nowhere having created the life that we CHOOSE rather than simply falling into what society dictates. We realise that everything is a choice, and even if it doesn’t feel like it at the time, you can stop running endlessly on the wheel of a unfulfilling relationship / job / health etc….

Have YOU Taken The RED Or BLUE Pill?

So I arrived in Spain in a new reality of being. Suddenly laying in the sun for 10 hours straight seemed so pointless, when there was good conversation with my parents (and Dom) available. Suddenly the warm days offered so much more than they ever have before as I sat in the shade talking and being more social than I can remember being on holiday!

I’ve come away from my time away fuller of the things that matter, rather than a darker colour on my skin. After all external beauty is only skin deep and what I’ve experience is so deeply nourishing that I cannot believe who I used to be!

And actually I now refuse to smother myself with a cocktail of evil chemicals in the name of suntan lotion, just so that I can sit in direct sunlight for longer. My skin would rather sit naked in the sun for a shorter period, fully receive the vitamin D it needs to be healthy, and then sit in the shade.

(in fact I’ve got just as good a tan)

I’ve been reading up on the use of suntan lotion and it’s quite scary.

It actually blocks OUT the absorption of UVB rays, which we need for the development of Vitamin D

And allows UVA rays IN, which are the harmful rays.

I would highly recommend you look into this yourself before spending a fortune on something that is damaging you beyond belief.

Speaking Your Truth

Last year we ate at one of my parents favourite restaurants in Javea, and had a long chat with the British owners: Laurie being front of house, and Cliff the chef (sound familiar!). Dom talked about being a clean-chef and they were uber interested in our philosophy.

One year on and we returned last week to find out that because of that conversation the whole restaurant is now gluten free!

AND the business is doing really well because of the change!

That is what I call real collaboration, and it is wonderful to be able to support such a forward thinking business so that they can support their customers in a more healthful way.

We had a fabulous clean meal, and now we know how it feels for Inner Guidance guests when they ‘know’ they don’t have to worry about what they are eating; that it’s all gluten and sugar free!

Please check out the La Cocina website and menu, and if you are travelling to Javea or surrounding area you must go for a meal! Plus they also have a take-away shop in the centre of Javea where you can pick up your favourite dishes to take back to your apartment / villa. My dad freezes these meals for ease 🙂

http://www.lacocinajavea.com

This year we had the discussion about sugar and hopefully there will be some sugar-free dishes on their pudding menu next year!!

So as we swing into holiday season (I cannot believe the schools break up this week!), don’t let excuses get the better of you.

Make good decisions, the ones that are right for YOU.

Take the RED pill.

Don’t follow the crowd.

Create your own reality.

Don’t be a sheep.

Be a phoenix!

Let go of who you were, and rise up from the ashes as who you want to be.

It is all possible if you only believe….

Stay in touch and let me know:

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Jenny Burrell Article

Jenny Burrell’s FitPro 2015 Report

When Rachel asked me to contribute to this week’s newsletter, I knew instantly what my summary would be. Throughout Wednesday (at Meeting of the Minds) Thursday and Friday, one theme kept resurfacing….the most successful wellness professionals are going to be those who are focussed on COACHING their clients towards making and sustaining lifelong change that goes throughout all areas of their life rather than being TOLD what to do to get fitter/thinner in the short term. As we mature into our profession, many of are finding that our clients need MORE and are prepared to invest in WELLNESS as opposed to FITNESS. For many of our clients, the lifetime toll of 20+ years of work and family life on their bodies and minds means that many of them are actually NOT simply seeking our help for ‘fat loss and fitness’ because in truth, none of this will occur on a deep level without addressing key lifestyle issues including sugar consumption, elevated cortisol, poor sleep hygiene, poor hydration and a high toxic load. And we all know now, that there is no fat loss and wellness if both our internal and external environments are toxic and contributing to hormonal imbalance.

So going deeper is ESSENTIAL if we really want to create long-lasting change for our clients. And for that, a long-term ‘coaching’ headspace needs to replace the traditional ‘get fitter and lose fat for Summer/Christmas/New Year mindset. Working in this way also better for our businesses….what would our balance sheets look like if we created compelling, results orientated packages where clients would need to commit to a 6 month programme (which is probably more realistic for deep change) and we were paid for our work on a monthly automatically recurring basis?

So obviously, if we are expecting deep commitment from our clients, we need to not only deliver but ‘over-deliver’ as no one is going to pay for a high-end, ‘whole-life, transformation package and be fine with seeing you once a week for an hour of being ‘told’ what to do……

So here are my forecasts for growth areas in our industry in the next coming 5-10 years….

Active Ageing – 60+ is no longer ‘old’ and currently apart from aqua and the odd seated class, many gyms and definitely the gym chains tend to generally ignore this section of the population. Could you create something exciting with more meaning that serves the deeper needs of the 60+ population in your locality?

Diabetes! Massively on the rise and sufferers really need bespoke programming for both exercise, nutrition and lifestyle….who’s speaking to the Diabetes sufferers in your locality?

Exercise & Lifestyle for Cancer Survivors – I know Cancer is a broad church but maybe choosing one that you actually have experience of would be a start. Can you ask family members and friends who have suffered, what help/information would they have have liked to receive during their recovery?

Exercise & Lifestyle of the Peri-Post Menopause Woman – in the UK there are 11 Million women 50 with ‘hormone bother’ in desperate need for good information and strategies to help them weather the storm associated with this life-phase…..for sure not 1 single gym chain has cottoned onto the fact that exercising and eating in your 50’s needs a whole different approach compared to strategies applied to the 20 somethings.

Can we be more? Can we serve deeper? I believe we MUST if we’re to embrace the deeper needs of those who seek our help and transform from ‘telling’ to truly ‘coaching’.

If you’re looking for an amazing on-line course that will equip you to serve the Peri-Post Menopausal woman DEEPLY, check out the ‘3rd Age Woman’ Online Certification from Burrell Education…find out more at: www.burrelleducation.com.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Budget Summary

By Andrew Crawford

I thought that today would be dedicated to having a look at the budget summary and the changes that will take effect. Some of these will be here in 2 – 3 years time when ALL other essential services will have gone up(gas, electric, petrol etc)….basically writing off any benefits these changes will make……..very clever…!!!

George Osborne presented the first Budget of this Parliament yesterday. The speech set out his plans for the next five years ‘to keep moving us from a low wage, high tax, high welfare economy; to the higher wage, lower welfare country we intend to create’.

Main Budget tax proposals

New taxation system for dividend receipts for individuals.

Proposals to restrict interest relief for ‘buy to let’ landlords.

Extension to the inheritance tax nil rate band available.

Other tax changes

An announcement of the amount of the Annual Investment Allowance available to businesses from January 2016.

Removal of the tax relief available on the acquisition of goodwill and customer related intangibles.

An increase in the amount of the NIC Employment Allowance.

The government also announced a number of changes to tax credits and Universal Credit as part of the welfare reforms aimed at reducing the growing expenditure in this area.

Our summary focuses on the tax issues likely to affect you, your family and your business. To help you decipher what was announced we have included our own comments. If you have any questions please do not hesitate to contact us for advice.

The Budget proposals may be subject to amendment in a Finance Act.

The personal allowance for 2015/16

For those born after 5 April 1938 the personal allowance is £10,600. For those born before 6 April 1938 the personal allowance remains at £10,660. The reduction in the personal allowance for those with ‘adjusted net income’ over £100,000 is £1 for every £2 of income above £100,000. So for 2015/16 there is no personal allowance where adjusted net income exceeds £121,200.

Commitments to increase the personal allowance

The personal allowance will be increased to £11,000 for 2016/17 and to £11,200 in 2017/18. These allowances are higher than those previously announced in the March Budget.

Legislation to ensure a tax-free minimum wage

The government has an objective to raise the personal allowance to £12,500 and the higher rate threshold to £50,000 by the end of this Parliament.

The government has announced that the personal allowance will automatically increase in line with the equivalent of 30 hours a week at the adult rate of the national minimum wage once the personal allowance reaches £12,500.

Tax bands and rates for 2015/16

The basic rate of tax is currently 20%. The band of income taxable at this rate is £31,785 so that the threshold at which the 40% band applies is £42,385 for those who are entitled to the full basic personal allowance.

The additional rate of tax of 45% is payable on taxable income above £150,000.

Currently dividend income is taxed at 10% where it falls within the basic rate band and 32.5% where liable at the higher rate of tax. Where income exceeds £150,000, dividends are taxed at 37.5%. Dividend income is deemed to be paid net of a notional 10% tax credit.

Some individuals qualify for the 0% starting rate of tax on savings income up to £5,000. The rate is not available if taxable non-savings income (broadly earnings, pensions, trading profits and property income) exceeds the starting rate limit.

Commitment to increase the 40% income tax threshold

The basic rate limit will be increased to £32,000 for 2016/17 and to £32,400 for 2017/18.

The higher rate threshold will rise to £43,000 in 2016/17 and £43,600 in 2017/18 for those entitled to the full personal allowance.

Personal Savings Allowance

Legislation will be introduced in a future Finance Bill to apply a Personal Savings Allowance to income such as bank and building society interest from 6 April 2016.

The Personal Savings Allowance will apply for up to £1,000 of a basic rate taxpayer’s savings income, and up to £500 of a higher rate taxpayer’s savings income each year. The Personal Savings Allowance will not be available for additional rate taxpayers.

Dividend Tax Allowance and rates of tax

The government will abolish the dividend tax credit from 6 April 2016 and introduce a new Dividend Tax Allowance of £5,000 a year.

The new rates of tax on dividend income above the allowance will be 7.5% for basic rate taxpayers, 32.5% for higher rate taxpayers and 38.1% for additional rate taxpayers. While these rates remain below the main rates of income tax, those who receive significant dividend income, for example as a result of receiving dividends through a close company, will pay more.

Comment

The government expects these changes to reduce the incentive to incorporate and remunerate through dividends rather than through wages to reduce tax liabilities.

The government also gives an example of a person who receives significant dividend income ‘due to very large shareholdings (typically more than £140,000)’ having to pay a higher rate of tax. It is unclear what this means.

Individual Savings Accounts (ISAs)

In 2015/16 the overall ISA savings limit is £15,240.

From 6 April 2016 the government will introduce the Innovative Finance ISA, for loans arranged via a peer to peer (P2P) platform. A public consultation has been launched on whether to extend the list of ISA eligible investments to include debt securities and equity offered via a crowd funding platform.

Enable ISA savers to withdraw and replace money from their cash ISA without it counting towards their annual ISA subscription limit for that year. This change will have effect from 6 April 2016.

Help to Buy ISA

The government announced the introduction of a new type of ISA in the March Budget, the Help to Buy ISA, which will provide a tax free savings account for first time buyers wishing to save for a home.

The scheme will provide a government bonus to each person who has saved into a Help to Buy ISA at the point they use their savings to purchase their first home. For every £200 a first time buyer saves, the government will provide a £50 bonus up to a maximum bonus of £3,000 on £12,000 of savings.

The government has now announced that Help to Buy ISAs will be available for first time buyers to start saving into from 1 December 2015. First time buyers will be able to open their Help to Buy ISA accounts with an additional one off deposit of £1,000.

Tax-Free Childcare scheme

The Tax-Free Childcare scheme will provide relief for 20% of the costs of childcare. The maximum relief will be £2,000 per child per year or £4,000 for disabled children. The scheme was scheduled to be launched in autumn 2015 but the launch date has been deferred to early 2017.

The current system of employer supported childcare will continue to be available for current members if they wish to remain in it or they can switch to the new scheme. Employer supported childcare will continue to be open to new joiners until the new scheme is available.

Employers’ workplace nurseries won’t be affected by the introduction of Tax-Free Childcare.

Free childcare

From September 2017 the free childcare entitlement will be doubled from 15 hours to 30 hours a week for working parents of 3 and 4 year olds. The government will implement this extension of free hours early in some local areas from September 2016. This free childcare is worth around £5,000 a year per child.

Restricting loan interest relief for ‘buy to let’ landlords

The government will restrict the amount of income tax relief landlords can get on residential property finance costs to the basic rate of income tax. Finance costs include mortgage interest, interest on loans to buy furnishings and fees incurred when taking out or repaying mortgages or loans. No relief is available for capital repayments of a mortgage or loan.

Landlords will no longer be able to deduct all of their finance costs from their property income. They will instead receive a basic rate reduction from their income tax liability for their finance costs. To give landlords time to adjust, the government will introduce this change gradually from April 2017, over four years.

The restriction in the relief will be phased in as follows:

in 2017/18, the deduction from property income will be restricted to 75% of finance costs, with the remaining 25% being available as a basic rate tax reduction

in 2018/19, 50% finance costs deduction and 50% given as a basic rate tax reduction

in 2019/20, 25% finance costs deduction and 75% given as a basic rate tax reduction

from 2020/21, all financing costs incurred by a landlord will be given as a basic rate tax reduction.

This restriction will not apply to landlords of furnished holiday lettings.

Other changes to property taxation

From April 2016 the government will:

replace the Wear and Tear Allowance with a new relief that allows all residential landlords to deduct the actual costs of replacing furnishings. Capital allowances will continue to apply for landlords of furnished holiday lets.

increase the level of Rent-a-Room relief from £4,250 to £7,500 per annum.

Pensions – restriction on tax relief

The Annual Allowance provides an annual limit on tax relieved pension savings. It is currently £40,000. From April 2016 the government will introduce a taper to the Annual Allowance for those with adjusted annual incomes, including their own and employer’s pension contributions, over £150,000. For every £2 of adjusted income over £150,000, an individual’s Annual Allowance will be reduced by £1, down to a minimum of £10,000.

The government also wants to make sure that the right incentives are in place to encourage saving into pensions in the longer term. The government is therefore consulting on whether there is a case for reforming pensions tax relief.

I have not touched on everything but on the areas I feel will affect you and your self-employed business.

Finally

Don’t forget to take a quick peak at : www.whatiszlogg.co.uk

Andrew James Crawford

www.fitnessindustryaccountants.com

www.facebook.com/fitnessindustryaccountants

www.twitter.com/tax4fitness

How to Train to Teach Pilates: Your Starter’s Guide Are you passionate about Pilates and ready to turn your love for movement into a meaningful

Reformer Pilates Teacher Training Boom at Choreographytogo It’s been an incredible week at Choreographytogo Education, with a huge surge of excitement and momentum around Reformer

Our Choreographytogo offers of the month end midnight tonight (30th June 2025) this is your last chance to grab these deals: 🪑 Sit Fitness Workshop

WOW! Record Turnout for Last Week’s Fitness Pilates Reformer Certification! What an incredible day!We had a record number of learners attend this week’s Fitness Pilates

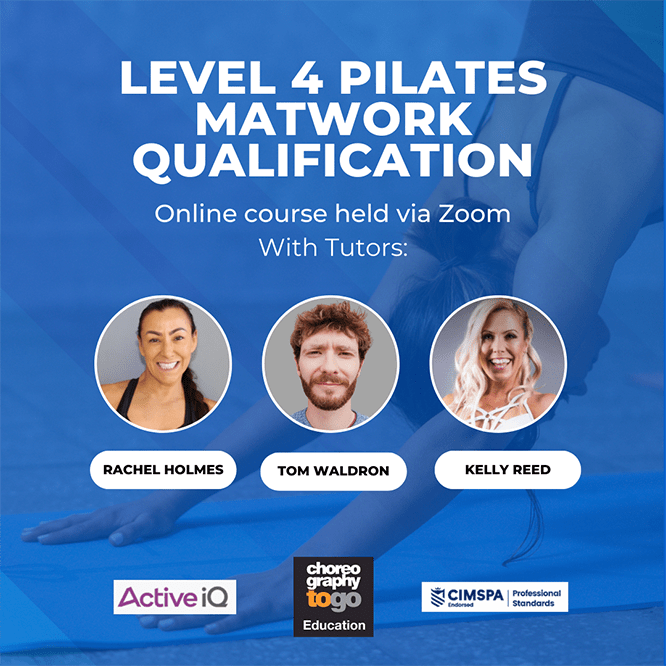

Quick Facts About Our Level 3 Pilates Diploma – Start Your Teaching Journey This July Are you thinking about becoming a fully qualified Pilates Instructor?

See our upcoming teacher training: Fitness Pilates Reformer – Online TrainingOur next online training for qualified Fitness Pilates teachers is happening onWednesday 23rd July – perfect for

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672