Fitness Pilates Hernia

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

Hope the newsletter finds you well. The schools are all back this week so i’ts time to think about the run up to Easter. Easter,as you know, falls early this year with Good Friday hitting us on 29th March so there are only 4 weeks to go. It is a good idea to give all of your existing classes a huge push on social media, get out and network, talks, business invitations. In fact, give it everything you have so you know what is working and what needs a tweak. Being a small independent allows you the freedom and flexibility to change things, move on or even walk away if something is not working and hit the next quarter with a fresh approach and ideas.

This week Marvin and I have been busy creating, writing and filming a new series of 8 week programmes which we will be launching in Spring. The 8 week programmes include Foam Roll, Stretch and Release, Resistance Bands and Tone, Kettlebells and Stability ball. They will come with music, workbooks and complete class set up information. There hasn’t been anything like this in the industry and we are looking forward to launching these very soon.

Kick Start Fat Loss™ Franchisees

I’m opening up the doors again for the 3rd intake of KSFL Franchisees. If you are interested in getting involved in the fastest growing Fatloss and Fitness Club please drop me an email. We are now launching the new KSFL Express and KSFL Executive programmes and the brand is growing at an incredible pace. Rachel@Choreogo.com

Kelly Reed New Fitness Pilates Progressions Workshop Tour.

We are both excited to be launching a new Fitness Pilates Workshop Tour that will kick off in June. The tour will feature Kelly presenting 3 new FP concepts. Firstly Fitness Pilates Progressions including new updates, exercises and ideas, moving into Fitness Pilates Focus where Kelly will look in depth at key areas including the spine, shoulders, lower back, hips, knees and ankles, and finally, Fitness Pilates for Special Populations. This is a subject we are asked about constantly so have now created a comprehensive workshop aimed at Instructors teaching FP for Older adults and Pre and Post.

You can read more about the tour click here The tour is open to all Instructors.

Fitness Pilates Clothing

You can see the new workout clothing and apparel here

Convention Mania

The two biggys are coming up so fast so make sure you are all booked up and ready for Blackpool IFS 21- 24th March and remember Jayne and I are running the UNITE pre convention using Pure Energy Mind Body 20. We now only have a few spaces left so click here if you are keen to teach UNITE.

Fitpro Spring Convention comes up fast behind on 12/13 April. Brilliant speakers and presenters over for both events so look forward to seeing you there.

Music

It’s been a while coming but at last we have created the first original artist HIIT mix with Pure Energy. I’ve been roadtesting it all week in my Kick Start Fat Loss classes and the feedback has been immense. Loads of recognisable super high energy tunes with 45 seconds on and a15 seconds break We will be launching it at IFS Blackpool in my KSFL session.

Rachel’s Fitness Niche and Class Ideas

1.Create a new class concept for 2013 – Are you teaching something unique and cool? Brand your programme, give it mass exposure on Social Media and get it out there. Group X is crying out for some new class ideas.

2.Are you teaching Fitness Pilates? Instructors report constant and consistent high numbers throughout the year. Add in specialities streams including Power Fitness Pilates, Fitness Pilates Conditioning, FP for Older adults and FP for Men only. FP is so versatile and can be tailed to suit so many niches.

3.Special Niches – There are still lots of untapped niches that no one or very few are providing great workouts and classes for. For example, the fastest group of women having babies for the first time are women over 40. I am convinced that a specialist pre and post natal programme designed for women over 40 who are first time mums group would be well received.

4.There are still only a very limited number of specialist classes and workouts for women during and after menopause, Men Only classes and courses including muscle building and fat loss is a huge market that very few are tapping into. There are just a few and I think there are many more niche markets that no one is tapping into as yet.

This newsletter has always been about encouraging Instructors to create your own style, your unique programmes and tapping into new niches. Don’t follow the crowd, create the future, and I do believe there are so many exciting avenues to go down. Research your idea thoroughly, trade mark and copyright it, trial it extensively, launch it and go for it!

I’d love to hear your views and comments tweet me @RachelHolmes

Jayne Nicholls

I have noticed of late the massive impact that Group X has had on the fitness industry. There would be no way 10 years ago that I would contemplate one of our target clients for fitness events, the female, married/single with children teaching classes in clubs and community venues would have children who would become fitness professionals and more importantly group instructors as a career move. You only have to look at Katie Bulmer Cooke second generation instructor to see how fitness instruction is passed on as a valid career choice. This is a wonderful thing as it shows how the business is evolving into a generational vocation. I recently found out that my Cross Fit Coach is the son of a loyal C2GO member and could in fact name another handful of second generation instructors, doing very well for themselves in fitness.

It just goes to show that this industry is evolving, it is full of opportunity and more important that the lifestyle and the renumeration is deemed to be passed on as desirable.

Next time you question your class numbers as negative, think about where you can take your skills and who can benefit from them. Fitness is no longer something that people fall into, it is a career move and one that pays. if you are not sure where to turn to make the most of what is going, on, ask one of the industry veterans who have made a massive success of group and 1 to 1 formats. This is mentoring at its very best.

Jayne Nicholls

Cori Withell

This week Cori has a new audio for you to listen to https://soundcloud.com/cori-withell/c2go-article/s-2gBNa

Katie Bulmer Cooke The Membership Fob

In my article this week I wanted to share something I’ve been setting up from my members that has been a real winner!

It’s a membership card key fob which I had designed and printed exactly like the Tesco Club Card, to include my logo, slogan, website and picture, using a print service I found on eBay.

I’ve teamed up with other local businesses that have an interest in either health, beauty, food, fitness etc and agreed that if my clients show their membership card when purchasing an item or service they receive a discount.

The local businesses are happy their products/services are being exposed to a new client base and my clients are happy because it adds value to their membership.

Within only a week I have the local organic cafe/shop on board offering 10% discount, a hair salon offering 25% discount Tuesdays and Wednesdays and 10% off Thursday to Saturday, a mobile beautician offering 10% discount on all treatments and a chiropodist too!

Next on my list is a butcher and fruit and vegetable supplier.

This is a fantastic way to network and spread the word about what you do!

In addition, there could well be a newsworthy press release in there too… ‘Local Businesses Join Forces To Get Sunderland Healthy!’

Have a great day,

KBC x

p.s. follow me on the new social network, Keek: ‘KBC1’

Revealed: The Top 5 Things That Will Increase by Getting Yourself in the Media by Yvonne Radley

A lot of my clients are people who work on their own, doing community classes and working part-time.

When they first sign up they wonder if they are doing the right thing. “I want to learn how to get my stuff in the paper but I’m not sure I have a story to tell,” they say.

Trust me, EVERYONE has a story to tell.

It can come from your past, your clients, your future projects.

You are an expert in your particular field and people are interested in what you have to say so don’t be shy.

Plus it’s been a great year so far for health and fitness stories, just look at the horsemeat burger scandal, gastric bands for kids, and the UK being named the fattest country in Europe.

You can ride on the back of any of these national stories as well as your own.

So what top five things will you gain by getting in the media? Check them out!

1: Top of mind awareness of WHO you are and WHAT you do

2: More people coming through the door to your classes

3: This inevitably leads to more revenue

4: Kudos for you because you start getting recognized as the Go-To Fitness Person in your town

5: Headaches for your competition who wonder how they can do what you are out there already doing!

Yvonne Radley

Big Me Up Media

E: yvonneradley@bigmeupmedia.com

Find me on Facebook for more tip and Twitter @yvonneradleymedia

How to make your message stand out and stick by Jill Gardner

I love to stand out from the crowd (I usually do because I am 5’11 in bare feet but in my much LOVED high heeled boots I am way over 6′)

But that aside, I still love to make an impact at networking events and meetings. One thing I have learned for sure is that when you make an impact at your first event you will invariably stay in the forefront of peoples’ minds and I don’t mean having to wear high heeled boots.

This is a poem I wrote for a recent networking event. I have even recorded it for you to watch too. The thing is, we can sound REALLY boring when we stand up and talk. People KNOW that they should be slimmer and healthier BUT they also know it likely means some hard work to achieve it (or they perceive it to be hard work at least).

A little humour in the right situation can really make an impact and allow you to build rapport and respect with people who would otherwise take a wide berth of you…. especially if they fear sitting next to you during breakfast or lunch!

Watch it here : Dear Fat Controller….. http://www.youtube.com/watch?v=VpRSkIeheQg

Dear fat controller, every diet I have tried

Despite eating less, my hips are still wide

Low fat, wholegrain and wafer thin too

Killing me slowly, it’s beige, dead food

It’s cheap and it’s nasty and it’s making me sick

I’m hopelessly addicted. Please help me quick

Well lucky for you. I know what to do

I’m waging my war against beige, dead food

Eat more not less but keep it real

Energised, focused and happier you’ll feel

I’ll teach you to cook fat burning cuisine

And show you how to be a fat burning machine

Online at home you can learn how to be

The best fat controller and diet free!

Big love, small tummies!

Jill – The Fat Controller @itsjillgardner www.hateitchangeit.co.uk www.facebook.com/hateitchangeit

The Price Is Right – Or Is It?

By Andrew Crawford

I wrote a short article today which I posted on my website entitled

“Stealth Tax – The Real Killer of Your Buying Power”

http://www.fitnessindustryaccountants.com/stealth-tax.htm

It explains briefly the real reason why the pound of 5 – 10 years ago is not worth the pound of today.

Just before I dive straight into this week’s article, I’ve just got to mention the story of the 2 Crown Prosecution Service employees submitting ‘false taxi fare’ claims totalling some £1,000,000.00. Come on now…… the CPS???

I’m not even going to go into that one but be aware that not EVERYONE in the Government, authority and Judges alike, are not squeaky clean…..yet they dish out sentences ….go figure..!!

Anyhow…..you may not think of yourself as a business but if you are working within the industry as a freelance instructor or personal trainer then you need to start thinking in those terms. Being successful in business means providing a service at a price that allows for a reasonable profit!

My aim in this feature is to get you thinking in terms of what it costs for you to give a client a PT session or teach a fitness session therefore to discover the profit margin. This will allow you to calculate a price per session that is reasonable and profitable. Not what is dictated to you.

There is the added benefit of making you aware of the costs that can be claimed against your income in order to reduce your tax liability. Keeping accurate records of what those costs can ease your tax burden. The ultimate goal is to have more money in your bank account to buy shoes and bags..!!

When deciding how much you will charge, or the price per session, what information do you use to decide an amount?

Many instructors price their sessions based on market forces. In other words, they charge what the ‘going’ price is. There is nothing wrong with this practice but it would be good for you to know the actual amount of money you are making!

First we must discover how much it costs for you to produce the product or service. These costs can be overheads, which are fixed or variable costs and direct costs, which are incurred in developing your service.

Let us look at some of the costs involved.

Insurance. Every instructor/trainer should protect themselves and their clients by taking out public liability and professional indemnity insurance. If you do not have an insurance policy, to cover unforeseen eventualities, you may put all your belongings at risk. The worst-case scenario is that if you’re the defendant in an insurance claim it can cost you thousands of pounds if you are not covered adequately. This means making sure that the policy covers the services you want to offer and the venues you use to perform these services.

You may wish to consider Personal Accident Cover Insurance as well as Public Liability and Professional Indemnity Cover. These policies will cover protection in the event that you sustain an injury, which may last for more than 8 weeks. The policy will state how much of your lost income it will pay per week. Again it makes sense if you are dependent on your business to pay your mortgage you should take steps to insure loss of earnings. Carefully check the policy to see exactly what it covers and be sure you have accurate records of your income, as this will be crucial in settling any claim you make.

Music is an important element in providing group fitness sessions and possibly for personal training sessions. It is important that you have the correct license to play music as part of your service. The PPL (Phonographic Performance Ltd.) provides instructors with the correct licence and work with several professional music suppliers to provide the licence and the music to instructors.

Certain music companies have a variety of schemes to suit the various needs of instructors/trainers and the cost of joining one of their schemes must be factored into your overhead costs. The PPL licence is a requirement under law when performing with music in public places.

If you are a freelance instructor you may have made the investment in a sound system and radio microphone. If you are a personal trainer you will have invested in equipment for monitoring, such as a heart rate monitor, blood pressure monitor, or body composition monitor. You may also have acquired various pieces of equipment to aid in the development of your client, such as a steps, weights, tubing, core board, the Flexi bar or a Pilates mat. Whatever your equipment requirements may be, they will need to be paid for and the cost factored into your overhead cost. All these costs are claimable.

If you had to stay away from home in a hotel, motel or holiday inn, for your course, update or convention then the costs of hotels/ bed and breakfasts needs to be taken into account. Make sure that you get the receipt recording the costs of the stay for your records!

You will also need to eat whilst away from home and the expense of Breakfast, lunch, dinner and snacks need to be added into the cost of the educational event. Socialising is included here, as that expense would not have occurred but for the training course. Again you need to keep receipts for accurate records!

There are books and monthly publications on the market, which are essential tools in your profession in terms of updates and awareness. You may also be building a comprehensive video library to keep abreast of new training concepts and choreography ideas. All these tools are a relevant business expense and need to be considered. Don’t forget the choreography download costs.

Business travel means that you keep a record of the miles you travelled to and from the venue whether you are going to a course, teaching a class, or training a client. Recording the odometer reading at the start of your journey and the reading at the end of the journey is important as the allowance is up to 45p per mile!

Don’t forget to keep track of the miles you travel to different venues around the UK to see your favourite presenter on tour or at a convention. Travelling to and from clients’ premises the gym or fitness studio will involve the consumption of petrol. Your car, van or 4×4 doesn’t run on air so a little bit of record keeping can help make sure you get the credit for this expense on your tax return.

Working in fitness means that you must look the part and make the most of your body by wearing the appropriate workout clothing and footwear. You need to keep track of the expense of your workout wardrobe. It is a fact that to look good for your clients visual pleasure costs money and to get the deduction as a business expense you need the paperwork to claim it!

What about your mobile, telephone, android, ipad and iphone? These are essential tools for communication with your client and other business purposes.

Again, these are legitimate business expenses but will require that you can separate what is business from what are personal telephone or mobile calls.

Freelance instructors will have a variety of venues to offer their sessions. If you are going to rent alternative space such as a village hall or gym time at a health facility then you need to keep record of the costs. Contracts will be part of the rental agreement and should be carefully considered. Certainly the cost of renting a venue or space needs to be part of your overhead figure.

If your business is run from your home, you will consume the extra charge of electricity, lighting and heating. Not forgetting the additional costs of installation of new telephone, fax lines or Internet facilities. Although these are claimable costs against the business they must be separated from personal everyday use.

So now we have itemised all the costs that are fixed, your insurance, licensing, equipment, hall hire or gym rental, let’s move on to the direct costs.

Becoming a fitness professional you will have invested in a training qualification, which may have been an Exercise to Music, Gym Instructor or Personal Training Certificate or walk fit, chair fit and whatever kind of fit programmes that are conjured up to entice your money from your purses and wallets.

The costs for this initial course were anything between £675 to 3,500. When you are considering a course it is vital to make sure it will qualify you for the activity you wish to offer as a service. Check the course curriculum carefully before investing in the training. Also be careful that you are aware of the total costs to gain the qualification (Watch out for courses that have part 1 and part 2 then part 3 rounding off with part 4!) and be sure to include any exam and/or assessment fees.

It is not good enough to have just one qualification these days. What tends to happen is as new ideas and concepts come onto the market you will need to be trained in order to start using the idea or pay for a licence to teach it. Keeping records of your continuing education is very important, not only the actual receipt for the course but the certificate that is proof of your expanding skill level.

Promoting your business through the different types of media will have varying costs. You need to keep records of any production costs for business cards, flyers/handouts or advertisements placed in newspapers etc. but also cost in any free demonstrations or giveaway sessions as these do have a value!

The most basic form of advertising is your personalised business card but it is one of the most effective. Make sure that your card is always available and has you current details on it! This will most likely be a recurring expenditure.

The printing of your personalised handouts advertising why clients should book a session with you and the services you offer is an inexpensive way to promote your business. You will find that having promotional information available at every session will soon provide you with more business! It is a way of relying on your current clients to help you gain new clients.

If you are serious about your business you may need to go further and construct a website. There are basic packages on the market, which allows you to construct your own, alternatively you can use the services of a Web Designer. Your site can be used to communicate with personal training clients, the club where you work, other fitness instructors, in fact a whole host of current and potential business contacts.

Financing loans/overdrafts & bank charges

You must keep a separate business account from your personal account. The first year is usually free banking, thereafter, charges will be applied.

Try not to go overdrawn. The banks will charge you for this along by sending you a letter telling you that your account is overdrawn and will charge you about £25 for it.

Some banks charge you for depositing and withdrawing your own money whether it be over the counter or using the ATM machine. In addition to this there are charges for standing orders, direct debits, cheques being paid in or out, the use of your debit card, statements being sent and a maintenance fee for looking after your account!

These charges can be claimed as an expense to your business.

If your business is going to be your full time occupation you may find yourself in a position where you need to borrow from banks or building societies to finance your start-up costs or business development costs. You will need a business plan in order to qualify for a loan and so you should carefully consider the repayment against the income you are going to make. Interest will be applied on top of the monthly payment of the capital and you should calculate this in your budget.

You may find that in order for you to progress your business, even if it is part time, professional advice is needed. The two areas that you may want to consider are the services of a Solicitor and/or an Accountant…uh em..!!

If you are signing a contract for hall hire, becoming an outside contractor for a club, taking over a lease or if you want to have a contract with each of your clients or subcontractors you may want to have it reviewed. If you do not have a contract for training of your clients you may want to have the initial one drawn up by a Solicitor.

This expense needs to be part of your costs and to keep them at a minimum don’t let them telephone or write letters to you. Try to cover everything in one free consultation meeting.

In order to keep your records in order, tax paid on time, correct relief claimed and your tax liability fairly low, you may want to engage the services of a qualified Accountant. Prices range from £175 to £600 pa to include completion of your Self Assessment Return. Prices will also depend on the complexity of individual tax affairs.

Agree fees in advance but beware variations during the course of the year.

Now, I hope that all this talk about costs has not put you to sleep or scared you to death!

Yes, the above has been covered before but I still receive emails asking the same type of questions. So I briefly touched on it here.

Once you have established all your costs, you will then be in a position to fix your price. Only you will know whether the price is right ….or is it?

See ya…

Andrew x

Have a wonderful day

Love always

Rachel x

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

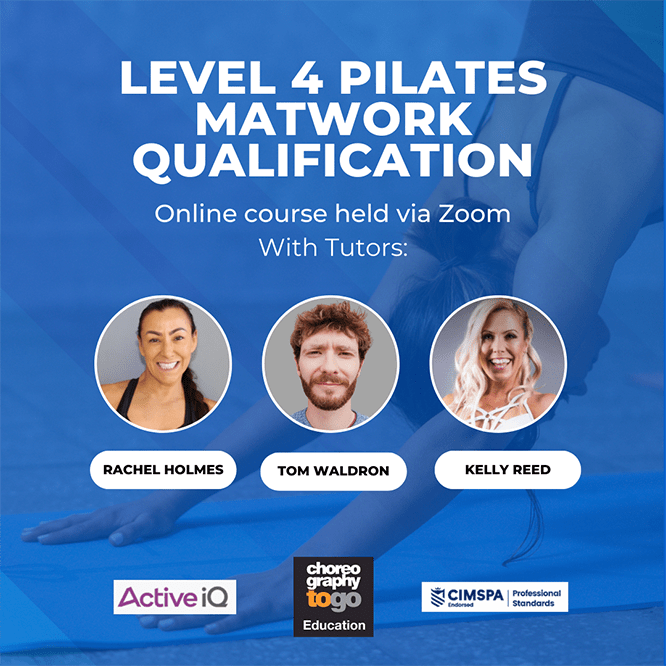

See our upcoming teacher training: Fitness Pilates Reformer – Online TrainingOur next online training for qualified Fitness Pilates teachers is happening onWednesday 23rd July – perfect for

What Are The Differences Between Fitness Pilates Reformer Certification and YMCA Level 3 Certificate in Instructing Studio Reformer: Group Fitness Pilates Reformer Certification Cost: £499Pre-requisites:

Pilates Teacher Training Courses In The UK How to Become a Qualified Pilates Teacher in the UK: Your Guide to Level 3 Training Pilates has

How to Train to Teach Pilates: Your Starter’s Guide Are you passionate about Pilates and ready to turn your love for movement into a meaningful

Reformer Pilates Teacher Training Boom at Choreographytogo It’s been an incredible week at Choreographytogo Education, with a huge surge of excitement and momentum around Reformer

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672