Fitness Pilates Hernia

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

How are you?

Hope you are having a fantastic week with busy classes & clients.

I got the Apple watch yesterday and OMG

I am over the moon with it!

Totally love it with all the health & personal care

apps for food, heart rate, steps, activity levels, music,

running & training.

It’s got me all inspired & motivated as I can see some

amazing potential with it in the fitness, & personal health space.

Let me know if you are a fellow apple watch aficionado.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

The Kick Start Fat Loss Online Academy launched

this week with the new 21 Day Home Workout programme

which has been storming.

I’ve ramped up the platform with a super slick

membership area called Customerhub

which is extremely professional & easy to use.

The 21 Day Home Workout Programme houses

all the workout videos, audios, downloads, meal planners &

graphics and is easily accessed via smart phone,

tablet, lap top or desk top -If you to get back onto your

own workout regime then come and join me.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Kick Start Fat Loss Scotland is coming.

For all the Instructors north of the border watch this space as we are

launching Kick Start in all the major cities this Summer & into Autumn

& I’ll be coming up very soon.

If you are interested in getting involved with

The Kick Start Scotland Franchise please Facebook message

me and we can keep you in the loop on dates and details.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Pop Up Summer Classes

Last summer I ran several outdoor “Pop up” classes on local parks and outdoor spaces.

Its a great idea and of course you have NO

OVERHEADS, plus its fun & makes a real change, so how do you do it?

Here are my top tips for running successful outdoor “Pop Up Classes”

1: Research outdoor locations.

2: Contact local councils for permission.

When I contacted the councils & said the classes are one off’s they allowed me to use the parks for FREE. It may be different in your area, but keep trying until you find free areas.

3: Check the weather forecast for the week and plan the class date & times.

4:Do you need music ?

If not take your Gymboss & do a HIIT style workout. Take along mats or tell clients to bring one.

5: Ramp up the promotion big style on all your social media platforms. Email your database and so a day by day count down to your “Pop Up Workout in the Park”

6: On the day take loads of photos and videos for your social media and promote the next one.

7:Encourage classes to bring children / partners for a really nice vibe.

I have mums bring babies in push chairs.

“Pop Up” is such a buzz phrase right now and who wouldn’t want to hit the local park for a fun, inclusive workout on a lovely summer evening or weekend morning.

Ideas

Pop Up Pilates in the Park

Pop Up Bootcamp

Pop Up Hiit

Pop Up Yoga in the Park

Let me know if this takes your fancy!

@RachelHolmes

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Have you checked out the latest Kick Start Magazine?

Click here to read

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Yoga On Drugs

By Jo De Rosa

My search began as a child.

I didn’t know what I was searching for, just that there was ‘something’.

My sister and I were brought up atheist but as I approached my teens I found myself secretly reading the Bible at night with a torch under the covers when I should have been sleeping.

But what was ‘it’?

The search continued during my teens in an ecstasy tablet.

Well actually quite a lot of them.

And they were usually taken back then whilst in a field dancing to rave music.

After a long hard slog of a week at work, it was party time, from the rave in a field to the London club, with ecstasy always coming along for the ride.

The party for me then moved to Thailand where I quite literally rocked up to party central on arrival. Little did I know that the cute bungalow operation whose cool tunes lured me in from the beach, was actually about to become the hottest and coolest club venue on Koh Samui.

I’d moved to Thailand in 2000 to become a yoga teacher, but hedonism wasn’t ready to let me out of her grip and the all night partying continued for a further 6 years at this happening beach bar.

I’d pop my first pill of the evening and watch the tourists speedboat over to the Full Moon Party whilst remaining in the comfort of my select group of fellow high-seekers. And as the tourists returned the next morning we’d all still be there pill-ed up to the eyeballs with our own DJ, still going strong and satisfying ourselves ceaselessly as the sun came up.

Connection

There is something about when I listen to really good progressive house music that takes me somewhere, inward, and I feel totally connected. When I was dancing under the stars there were no worries, cares, problems, issues or dramas.

Life was perfect.

I was at one with myself and the whole world.

CONNECTED to source.

An escape from normality and transported to a dream world.

It’s like the music touched a piece of my soul and there was an ultimate connection.

The drugs enhanced this a-hundred-fold it seemed.

Magic opened up within me.

Space.

I felt complete.

I HATE you, I LOVE you

Back then I was partying with my ex and we fought all day long, but take us to a party and fill us with ecstasy and we were a team.

The connection was there, and in that moment (and for however long the high lasted) we were best friends.

I loved him unconditionally in the high of ecstasy, and the music accompanying it, all expectations and problems magic-ed away.

How could we be so happy by night and so miserable the next morning??

It didn’t make sense.

Another dimension.

Another world.

Heaven.

A high so high that nothing could bring me down.

Magic opened up within me.

Space.

I felt complete.

But god was the comedown awful, made all the more terrible by hating him again once the veil of drugs had been lifted….

Who The Hell Am I?

My life was now playing out in two different directions.

The old Jo: party animal

The new Jo: yoga and health

And the two were about to collide as I was on the verge of teaching my very first yoga class.

The plan was that first class to be in my gorgeous rooftop yoga studio overlooking the sea and Koh Phan-gnan on Wednesday 3rd January 2001.

The reality was my first class was a few days earlier on New Years Day, on the beach at before-mentioned ‘venue’ having been up all night on ecstasy and having just consumed a magic mushroom omelette ‘because I was hungry’, and wanted to stay high.

I’m not proud of it and actually cannot believe I am admitting this.

But ‘authenticity’ is my new middle name, and to do it justice I have to come clean….

By this time yoga and meditation had been in my life for about 4 years and I was getting high from it: the same kind of high that drugs and house music had been giving me.

I loved it!

And so I juggled my natural and chemical highs for the next few years, but the incongruence became too much of a strain and in the end something had to give.

Epiphany Moment

I now KNEW that yoga and meditation was what I had been looking for all these years.

This was the connection, space, belonging and high that I had been searching for my whole life.

And so the pendulum began to sway further and further towards the new Jo. The old me just didn’t fit any more.

I tried her on a few final times but it took longer and longer to get back to the healthy version of me, and in the end enough was enough.

I was done.

There was going to be no more chemical highs.

That was 2006.

Goodbye cocaine, goodbye cigarettes, goodbye ecstasy.

A Life Of Service

The hedonistic existence that had been normality for my whole adult life fell away, and what emerged was a desire to share what I had learnt along the way.

How did I ‘give up’ the toxic lifestyle that I had lived for so long and have no apparent withdrawal? Why do some hanker after a drink years into sobriety, while I find it easy to say “I’ll NEVER drink again.”?

I’ve unlocked the door, discovered the answer and happily live in a clean and sober world. EVERYTHING in my life now comes from a place of wanting to serve others and I look back on my old life sometimes wondering who the hell I used to be, but ultimately so thankful that I found my way out. If I hadn’t of found yoga and meditation I wonder where I’d be today, and I know that for sure I would not be as happy as I am now (and probably I’d be in a real pickle!).

However, I have no regrets because it is all part of who I am.

And now it’s time to show everyone HOW I did that. How I turned my life around.

How frigging EASY it was!

The New Way To Get High

Although the drugs are thankfully long gone I still love and listen to the music, but now it’s when I am exercising.

I have so much energy from my clean and healthy lifestyle!

I’m getting YOUNGER everyday.

My morning high is spinning, planking, sprinting, squats: a HIGH ENERGY start to the day!

And what I realise is that the music that I’ve always loved helps me push through those difficult workouts.

It drives me.

I LOVE getting out of my comfort zone and pushing my limit: that is who I am.

And I accept who I really am (definitely not something that I’ve always been able to do, but VERY liberating. I highly recommend it!).

And MEDITATION is my real magic.

Where I get my connection these days.

It is REAL, PURE, and there are no hangovers!

And do you know what, the high that I sometimes get when meditating is SO MUCH HIGHER than any drug I’ve ever taken, and in my opinion I have found the ultimate high anyone can: the one you find within yourself.

For me life has come full circle.

The search is over.

Day-to-day life is perfect and I feel truly blessed.

The Expectation Of Others

Is this who you thought I was?

Have I surprised you?

Shocked you perhaps?

Maybe you thought yoga teachers were packed up in shiny boxes eating perfection for breakfast and sleeping in a bed of flawlessness?

Perhaps you assumed that yoga/meditation teachers have had it easy?

That there has been no struggle?

It’s ok to be you you know.

Whoever you are or have been.

And I wanted to share a little bit more about me so that you can see that wherever you are, and whatever you’ve done, what you are doing NOW is what counts.

So make it count.

Believe in yourself.

Because I believe in you.

What you are thinking NOW is shaping your tomorrow.

It matters, YOU matter, so lets do this!

Let’s turn the music up, and get on the dance floor of life!

In a couple of weeks I am holding a one day workshop and will exploring Meditation and Manifestation in great detail, so if you’re up for diving in to the life that you’ve always dreamt of then I’d love to meet you at my retreat centre in Suffolk!

Meditation and Manifestation

Inner Guidance Retreat Centre, Lavenham, Suffolk.

Saturday 27th June

10am to 5pm

Let’s get real, and let’s get clear about where you are headed….

Let me know if this blog resonates, and I’m dying to know how REAL you are keeping it. Namaste xx

Web: www.innerguidance.co.uk/product/meditation-and-manifestation-workshop

Email: jo@innerguidance.co.uk

Facebook: InnerGuidance

Twitter: @Inner_Guidance

Copyright: Jo De Rosa 2015

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

A Simple Dog Show Wins……It’s Got To Be Magic…!!!

By Andrew Crawford

Ok Ok…So I watched some TV last weekend…..It was the finals of BGT what did you expect…!!!

For me UDI, IMD and the other dance group along with the Choir were having my vote. Highly skilled, highly rehearsed, highly executed, Highly expected to do well……or so you thought…!!!

Not taking anything away from the tight rope performance but the bitter taste of defeat was written across a lot of faces…!!!

Just an aside……

You may not have escaped this but have you seen the video clip going around of that Policeman in the US drawing his gun on the unarmed teenagers and then throwing down the bikini clad girl??????

Oh…….and don’t let me talk about Football’s Fieving FIFA Fellows Fiddling Fans Finances………….!!!

So Andrew…

What has the dog’s winning act last week got to do with Accountancy & Tax?

Well……without revealing it the lady had 2 dogs. One you saw, the other you didn’t. It was not until she revealed it did anyone know.

Just like a second property you let out. Unless you reveal it…nobody knows about it…….!!!……….Do they??

So why is that important?

The Taxman wants their bit of the pie….that’s why..!!…and if you don’t declare your income properly or capital gains when you sell, you could be in big problems….they can make money disappear from your bank account from additional charges, penalties and interest.

Sorry…just an aside here…….Well done the Arsenal…well deserved..!!

Let us now run through the taxes associated with buy-to-let properties.

Mortgages and tax

Firstly, there is something you need to know about mortgages that makes it obvious you have been letting a property.

You need a different type of mortgage to the type you would get for your own home.

Lenders will also want to know if you have begun renting out your home because this is usually not allowed under the terms and conditions of a residential mortgage. Often you will have to move to a buy-to-let rate.

The rates tend to be higher than residential mortgages, which reflects risks such as tenants not paying rent and you defaulting.

Buy-to-let is treated as an investment so is subject to income tax on rent and capital gains tax on sale. You will also have to pay stamp duty on the property purchase.

This interest is fully claimable against your rental income. So ensure you utilise it to reduce the additional income tax.

Stamp duty and When To Claim It

The first tax you will need to pay if you are building your buy-to-let portfolio is stamp duty when you purchase a property.

Claim this by offsetting it against any capital gains tax when you sell.

Income tax on buy-to-let

You will have to complete a self-assessment tax return to pay income tax on any rent you receive.

You can claim for interest on buy-to-let mortgage payments, as well as any arrangement fees for setting up loans for the property.

Any maintenance costs on the property and letting agent fees can also be claimed for.

You can also claim for buildings and contents insurance, council tax and utility bills if your tenant is not paying them.

When you come to sell your buy-to-let property, there will be capital gains tax to pay on any profit.

CGT kicks starts in when you sell a buy-to-let property at a profit of more than the annual allowance, currently £11,100 in 2015/2016.

It applies to any property which is not your main home, known as your Principal Private Residence. This gets a special exemption. (See below)

CGT is lcurrently 18 per cent or 28 per cent depending on whether you are basic rate or a higher rate taxpayer.

How To Cut The Tax on Buy-to-Let Profits

I knew you were gonna read this part

So….there are two reliefs you can get on your CGT bill plus other fees.

Private residence relief

Lettings Relief

Stamp Duty & Agent fees

Private Residence Relief

If you have a former home that you let and then sold, you may be able to reduce your capital gains tax bill.

If at any point a property has been your only or main residence, the last 18 months of ownership qualify for a tax break known as private residence relief, which makes it free of capital gains tax over that period.

If you own two properties, you can elect which one is your main residence, but must tell HMRC within two years of purchasing the second one. You can switch the main residence but must keep HMRC informed by making a written election, known as a PPR election.

Lettings relief

A further element called lettings relief can further reduce your CGT bill.

Lettings relief applies where the property has at some point been an individual’s only or main residence

Letting relief is worth the lowest of three amounts: private residence relief already claimed, the value of the increase in capital gains which occurred during the period when the property was being let, or £40,000.

When combined with the annual £11,000 CGT allowance, these two reliefs can often take bills down to ZERO

.

Offsetting stamp duty and estate agent’s fees

You can reduce your CGT bill by deducting some of the expenses associated with buying and managing a property.

You can offset costs such as the stamp duty you paid when you purchased the property as well as solicitors’ fees, estate agent’s fees to market the property, refurbishments costs that are capital in nature and have not been offset against the rental income and surveyors’ fees if a survey was carried out when you purchased the property.

You may also be able to offset losses on other property against your capital gains tax bill.

Inheritance tax

When you die your buy-to-let portfolio will form part of your estate.

This means whoever inherits the portfolio may have a tax charge to pay of 40 per cent if the total estate exceeds £325,000 or £650,000 for married couples.

There are ways to reduce your inheritance tax liability by making gifts to relatives and putting bits of your estate in trust. This is much more complex with a property than it is with cash, shares or funds, which can be passed over in small chunks.

Allowable Expenses for Residential properties

Let’s not mess about…….Claim the following in FULL

letting agents’ fees

legal fees for lets of a year or less, or for renewing a lease for less than 50 years

accountants’ fees

buildings and contents insurance

interest on property loans

maintenance and repairs to the property (but not improvements)

utility bills, like gas, water and electricity

rent, ground rent, service charges

Council Tax

services you pay for, like cleaning or gardening

other direct costs of letting the property, like phone calls, stationery and advertising

Unfortunately you can’t include ‘capital expenditure’

Don’t forget this Extra 10%

You can claim 10% of the net rent as a ‘wear and tear allowance’ for furniture and equipment you provide with a furnished residential letting. Net rent is the rent received, less any costs you pay that a tenant would usually pay, eg Council Tax.

What About Losses??

You can offset your loss against:

future profits by carrying it forward to a later year

profits from other properties (if you have them)

You can only offset losses against future profits in the same business.

Phew……Sorry…this was longer than I intended…but I think that’s all you need to know….it’s like a roller coaster….opps there we go…Alton Towers all over again…!!

Finally

If you’re thinking of going to Alton Towers any time soon, please check out its Health & Safety first. With that recent accident people will definitely be nervous

I can just imagine if the collision happened with the Duelling Dragons…!! Lord Have Mercy…!!

By the way………Lock up your daughters. Too much rubbish is happening out on the streets right about now. If Anything happens to any of mine……..Somebody’s gonna disappear…just like magic..!!

Andrew James Crawford

www.fitnessindustryaccountants.com

www.facebook.com/fitnessindustryaccountants

www.twitter.com/tax4fitness

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

See our upcoming teacher training: Fitness Pilates Reformer – Online TrainingOur next online training for qualified Fitness Pilates teachers is happening onWednesday 23rd July – perfect for

What Are The Differences Between Fitness Pilates Reformer Certification and YMCA Level 3 Certificate in Instructing Studio Reformer: Group Fitness Pilates Reformer Certification Cost: £499Pre-requisites:

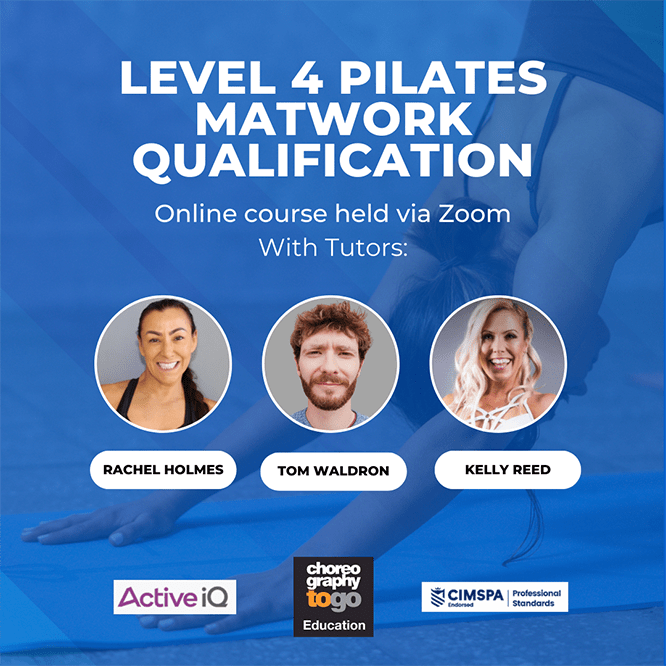

Pilates Teacher Training Courses In The UK How to Become a Qualified Pilates Teacher in the UK: Your Guide to Level 3 Training Pilates has

How to Train to Teach Pilates: Your Starter’s Guide Are you passionate about Pilates and ready to turn your love for movement into a meaningful

Reformer Pilates Teacher Training Boom at Choreographytogo It’s been an incredible week at Choreographytogo Education, with a huge surge of excitement and momentum around Reformer

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672