Fitness Pilates Hernia

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

Wishing you a fab Thursday and here is today’s Instructor C2GO newsletter.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

As Facebook settles into a world for the 30 + Instagram is set to be the next biggest social platform as it grows on a daily basis.

But remember it is still new & finding it’s feet.

It really is advantageous for savvy Fitpros to start building a profile over there.

I’ve been posting mini 15 sec choreography clips & they have been ramping up my followers and subscribers do check it out on RachelLHolmes

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Planning your own local Master Class or Fitness Event

Organising a master class event in your area is a brilliant way to raise your profile. Especially with social media it’s just brilliant for your PR.

Film the event and post clips on all social media sites,writing articles and posting them on your own website and on Facebook also helps build your credibility.

Build your profile on social media, posting lots of videos with you presenting your unique class ideas or clips of your talks.

Engaging with other Fitness Presenters and event organisers is a great way to get noticed, so network.

If you want to be a presenter & teach at conventions organise you own local events – this is a fantastic way to get noticed & build your tribe.

ALL convention organisers are looking for new and fresh talent, who have a good following and are extremely active on social media and if they like what they see will invite you to present at their events.

What to present?

1. Choose a topic that will motivate enthusiasts,club members and Instructors. Come up with YOUR own brand and style.

2. Set the date and time?If it’s being held in your local club – get members to bring guests and non-members or hire a venue.

3. Create your marketing material. ?Create stylish posters and flyers and email to everyone on your email list and mail out to your database.(All presenters are constantly trying to build their own database so always ask people for contact details).Use Facebook/Youtube/Twitter and your own Blog and website to promote.

4. Send a sponsorship letter to potential sponsors. Target local businesses in your area and email a letter to them asking them to sponsor your flyers and marketing material in exchange for promotion. Eg Local sports shop, local restaurant, takeaways, women’s clothes shop etc

5. Practise, Practise and then Practise some more?Your teaching skills should be rehearsed and impeccable.

6. Send press releases to all local press and take photos on the day to send press releases to all Fitness magazines

7. Decide whether you would like to make the event a freebie for publicity or charge. All presenters when they start do many things for free to build up a name

On the Day

1. Welcome everyone personally as they register

2. Give away a registration pack containing your information, how to book you for another event, your biography and contact details

3. After the class thank everyone and tell them about the next event you have planned.?4. Make sure you film clips of the day, get testimonials and put on your Facebook profile?

The industry needs more new presenters with new ideas, so if you think you have what it takes……….. Are you a budding presenter?

Tweet me with your video clips @RachelHolmes

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Ab Evolution Workshop with Kelly Reed-Banks

Kelly will be touring in May/June with a 3 hour Ab & Core workshop.

All the booking details will be out in the next few days.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

New KSFL Franchisee Opportunities

Amber Rich launched her brand new KSFL Club in Pembrokeshire this week to 57 people. She even had a chef to prepare the KSFL food

Click here to read Ambers story

I am looking for fitness instructor entrepreneurs – Is this you? If you would like to join the KSFL Business check out all of the details here and Facebook message me for a chat

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Launching in KSFL & FP in Dubai

Kelly & I will be over in Dubai launching Fitness Pilates & Kick Start Fat Loss so if you are in the UAE & would like to get involved in the KSFL Business & teach the programme or train with us for FP here are the dates.

Kick Start Fat Loss Launch evening – Free event for all Instructors with Rachel & Kelly Wednesday 11 March 2015 730 – 930pm Tiara Health Club, The Palm Dubai

Please email me for your invitation or Facebook message me for details.

I am looking for Instructors in all UAE locations & countries.

Fitness Pilates 2 Day Training Course with Rachel

12 / 13 March Fidelity Health Club

Level 2 Exercise to Music Qualification with Kelly

12 / 13 March – Golds Gym

Step Qualification with Kelly & Rachel

14 / March – Golds Gym

Click here to book or message me to book your place on the KSFL Launch evening.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Are You Meditating In Your Unique Way?

“How do you meditate?”

“Is there a right way?”

“Is there a wrong way?”

“Can I do I do it lying down?”

“My mind wont slow down….”

Have YOU actually tried to meditate on a daily basis?

We find so many barriers to?experiencing meditation.

And, I am SO not an expert.

But if I can do just 5 mins a day?…..then I know you can.

I bet you have a jumpy,ideas filled, to do list crammed,?things to do crowded, projects to finish mind that never stops chattering. Dwelling on the past, projecting into the future, steaming of down negative highway, dreaming &?fantasizing at a million miles an hour.

Let’s train those meditation muscles then. Build it up from just a few minutes a day – just like a training programme. MY QUICK TIPS For BUSY CRAZY BEGINNERS

Heres What I do…

I write down & think about what help & guidanceI need for the day.

Then spend 5 – 10 mins,maximum, aiming to sit in stillness, breathing?& listening to what comes up.It’s really not complicated or difficult.

1: Find a nice, tranquil space to sit or lie in.

2: You can use music or a guided mediation at first. There are millions on youtube & itunes. I love Gabby B’s, Marianne Williamson but there are literally hundreds to try. Sometimes I use a guided meditation. sometimes. I like quiet, depends on my mood.

3:Breath slowly & deeply and allow thoughts?come in & out of your mind – all thoughts/any thoughts.

4: Listen to what comes up, feelings,emotions, listen to your inner voice.

I like to write in my notebook?immediately after as I often get?ideas & inspiration. Gabby B calls this ~ing writing.

I really enjoy this part & it’s always just total scribble. You may only mange 2 minutes but thats so cool. 2 minutes of clarity,of getting your day in order, of dealing with thoughts/emotions & feelings. Is so GOOD for you.

You don’t have to mediate in a morning.I often do it as an afternoon pick me up. It’s YOUR meditation you can make it work however YOU want to.

I hope that helps.As I say, I’m really no expert But I hope my little simplistic guide helps you get into it.

Let me know if you try to mediate.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

BPR – Banks Politicians & Rules…!! By Andrew Crawford

Do you believe Politicians?

In the light of the latest shenanigans within one of the main high street banks and the links to politics are you surprised that no one has been prosecuted?? This is true tax dodging which is illegal.

Once again, it has taken a whistle-blower to uncover the horrible truths as to who what why and when. However, standing back and looking at it from a different angle……it is not illegal to have a foreign bank account. Once your money is NOT remitted back into the UK…then there will be no UK tax on income generated outside the UK. Therefore…………Bank abroad….it ain’t illegal yet…………but they’re working on it…!!

Bank on yourself

So Andrew……What has Banks Politicians and Rules got to do with Accountancy and Tax??

Well….since you’ve asked, let me quickly run over some quick Rules and Bank some of my hints….!!

It is important to remember how we determine whether a person is liable to UK tax. We have to look at their RESIDENCE. Now I don’t intend to go over the full details today because I’ve got to get up early to complete day 12 workout of my KSFL 14 day detox programme. Rule: If you are UK resident you are liable to pay tax on your worldwide income. However, if you are non-resident you only pay tax on your UK income.

How do they determine this Andrew?

If you have been in the UK for 183 days in the tax year you will be UK resident. If you decide to leave the UK permanently(3 years or more) you will be treated as non-resident from the date of departure. To establish this non-residence your visits to the UK must average less than 91 per annum over a 4 year period. All individuals pay income tax regardless of their residence. If you are UK resident you will pay tax on your foreign income. I’m kinda setting the scene here because some of the individuals you may be reading about may or may not fall into these categories, so the media will try and damage their reputation when it is clear they have really done nothing wrong except to ensure they establish themselves to avoid paying UK tax. The whole point to this is to legally avoid paying tax therefore some tax planning must be utilised.

It’s simple really… If you knew your foreign income was going to be taxed if you brought it into the country, would you bring it in?

Hint. Another important factor is timing. So…Hint…for example you would sell your assets in a different tax year from the year you left the UK. Great tip there…!!

Other tax planning tools you have at your disposal…Hint.. Trusts also offshore companies.

The programme on Monday from Panorama concentrated on Switzerland and the HSBC…… I was wondering why they didn’t include other popular destinations to keep your money and assets outside of the UK…for instance The Bahamas, Cyrus, Isle of Man, Monaco, Seychelles. These are classified as Tax Havens and are used to reduce your tax liability. There is nothing illegal, it’s been done and is continuing to be done as I write. This is a wide subject but I wanted to just whet your appetite to the fact that you shouldn’t listen to everything the media tries to ‘sell’ you. I always think about the things they are not telling you….!!!

Where do Politicians come into this scenario??

Well, the list of people utilising such structures includes some well-known Politicians and the bank knew that the advice they gave out was solely to evade tax….!!!!!! What will happen to this large multinational high employer of UK workers, bosses, CEO’s and Managers who knew what they were offering??? Absolutely nothing.

“………HMRC received list of 6,800 HSBC customers with Swiss accounts in 2010………..”

“……..Just one person prosecuted, despite £135m in owed tax being recovered……….”

It’s one Rule for them and one for everyone outside the Politicians and Banking clique..!!

Finally It’s Lover’s weekend this week. Don’t forget to order in those roses by Friday night. Oh…..and remember the card….that’s important..!! If you’re staying in….I hear oysters are good this year…..Enjoy.!!

Andrew James Crawford

www.fitnessindustryaccountants.com

www.facebook.com/fitnessindustryaccountants

www.twitter.com/tax4fitness

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

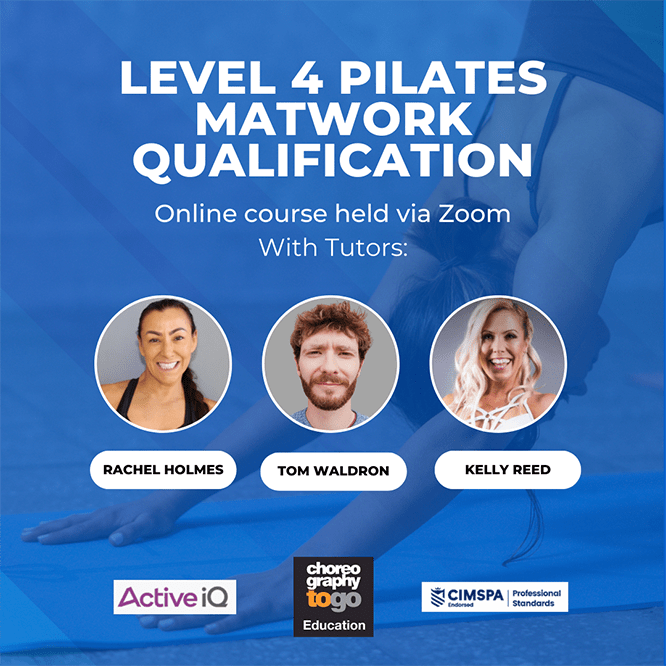

See our upcoming teacher training: Fitness Pilates Reformer – Online TrainingOur next online training for qualified Fitness Pilates teachers is happening onWednesday 23rd July – perfect for

What Are The Differences Between Fitness Pilates Reformer Certification and YMCA Level 3 Certificate in Instructing Studio Reformer: Group Fitness Pilates Reformer Certification Cost: £499Pre-requisites:

Pilates Teacher Training Courses In The UK How to Become a Qualified Pilates Teacher in the UK: Your Guide to Level 3 Training Pilates has

How to Train to Teach Pilates: Your Starter’s Guide Are you passionate about Pilates and ready to turn your love for movement into a meaningful

Reformer Pilates Teacher Training Boom at Choreographytogo It’s been an incredible week at Choreographytogo Education, with a huge surge of excitement and momentum around Reformer

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672