Fitness Pilates Hernia

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

A very positive day dawns as I’m packing

my bags once again for London to hot

foot it down to the all new Fitpro convention at XL.

There are some super top notch

educational sessions this year.

Loads of new speakers, lectures & sessions

& a whole new look & feel to the event.

The 2 days promises to really deliver with

very current & relevant content.

I’ll be blogging & tweeting all weekend

so if you can’t make it & want to hear

all of the realtime action follow me

@RachelHolmes.

I am presenting UNITE with Jayne & Fitness Pilates

& if you are around…Do pop over & say HI!

You can still grab a last minute place

by going to http://www.fitpro.com/live14/

___________________________________________________________

The Rachel Holmes Podcast Show with Jenny Burrell

Episode 4

I interview Jenny this week & get right down in deep conversation

about what makes this trailblazing maverick tick.

Please subscribe to iTunes

You can also listen to the brilliant interviews with

Bobby Cappuccio, Paul Mort, Jayne Nicholls

_______________________________________________________________

KS EXTREME

We concluded the initial roll out of KS EXTREME

last weekend at the REEBOK club to a packed studio.

The dates have been in high demand & KS Extreme classes have now

being launched nationally & providing a viable alternative to Insanity &

other HIIT programmes due to the variety of the KS programme.

We have 4 different options depending on the client

group KS EXTREME. KS SUPREME, KS SPIKED &

KS FP all aimed at different demographics.

Due to the intense uptake Kelly & I will be running more

training in the Autumn & the dates will be ready for booking

in the next few days.

Do you want more info on nutrition, fatloss, recipes & all things KSFL‹™

then add your email to the KSFL List today

Click here

______________________________________________________________________________

New Music – HIIT Volume 4 from Pure Energy

We have created the 4th HIIT Workout in the Pure Energy Series

& it is flying out of the PE offices.

If you are loving your HIIT Workouts then check out

my latest release.

______________________________________________________________________________

Do you want to build

your Fitness Business?

I have created a new specialised newsletter

including video tutorials, audio & blogs

for Fitness Professionals that are serious about

creating an online fitness business.

This will include marketing, PR ideas, Facebook adverts

new social media platforms, technology etc

As I’m offering more & more business coaching,

consulting & mentoring programmes this will

be a regular resource for entrepreneurs who are

looking to move towards this area.

Add your email address for my 15min

VLOG on My Top Tips For Creating

Your Online Fitness Business.

______________________________________________________________________________

Get More Done in Less Time – Hey Control Freak

YOU have to get a VIRTUAL ASSISTANT3.

You have got your mojo back, the fire in your belly is burning pretty HOT, so now you are ready to take on the fitness world, but you only have a few hours every day to do it all. No one in the universe can run the show themselves no matter how small their business is. Fitpros LOVE teaching but don’t like admin so much, so get help even if it’s a few hours a week.

1.Firstly, make a list of everything you have to do in your business and I mean everything – e.g. Responding to emails/Social Media/Writing Newsletters/Running Facebook Ad’s/ and a list of everything you have to get done personally.

2.Create Step by Step Instructions, a repeatable system that someone can follow. I use screen flow which videos my computer screen and my voice as I make a little training video showing my VA how I want something done. I have tons of little videos that I have on file demonstrating exactly how I want things done.

3.Start slowly, train your VA and give them feedback. They won’t get everything right straight away, be patient and you will get there.

4.Be clear with your instructions and exactly what you expect and always pay promptly.

5.There are lots of professional VA’s around. Ask on Facebook/Twitter, Google VA’s or use amazing sites like People Per Hour, Elance and Odesk to find the right person for you.

6.Expect to pay between £8 – £12 per hour (Cheaper if you use a VA from overseas) depending on the VA’s expertise and the jobs you need doing.

When hiring, conduct a Skype interview, ask for references and proof of work.

I cover how to hire VA’s in depth in the Fitness Business Academy Mentoring Course

which I will be opening up very soon for the second intake.

What’s In Your Cabinet? Be Afraid…Be Very Afraid..!!

By Andrew Crawford

A cabinet is where you keep things locked up for safe keeping. Paperwork categorised for easy retrieval. Complete files. Restricted access.

Well, the Cabinet I’m referring to has again showed the world it’s ‘hidden’ contents and agenda…in fact…not entirely….because 114 of the Cabinets files have mysteriously ‘disappeared.’

So what have these 114 files got in common?

The Home Office’s top civil servant told MPs that 114 files detailing allegations of child sex abuse in Westminster were probably destroyed.

“……Mark Sedwill admitted he was “concerned” but insisted people “should not assume there was anything sinister” about them going missing…………”

?Are you kidding???? 114 all at one time….?? Sinister is not a word I would use in this case.

Further………..

There are claims that the department funded PIE – a group that lobbied to

legalise child sex.

Be Afraid,,,,,,,,,,,Be Very Afraid…

I ain’t going any further with this as there are more questions than answers and the cover up process of the names of well-known Politicians and their Cabinet antics has been well underway. We mere taxpaying civilians will never be privy to secrets that lay beyond those Whitehall walls.

So Andrew……..

Why do we have to be Afraid? And what’s Cabinets got to do with Accountancy & Tax?

Well Brothers & Sisters, let me tell you a story.

A couple of weeks ago I received a call. It was from a PT who had been contacted by the HMRC. They virtually told him that they knew he had been working self-employed since 2008 and that they assess their tax based on their ‘estimate’ to be £33,500……………..oh …….and they want this payment by this Saturday…!!!

Are they gonna get this amount? B@ll@x are they…!!

The point is, they had found something ‘Hidden in the Cabinet’ ..they had made a Discovery Assessment.

&n bsp;

Instead of me raking my brain to remember the list, I have used the HMRC’s own interpretation here….

Discovery Assessments

HMRC has the power to make ‘discovery assessments’ to prevent a loss of tax.

The Act provides general rules for HMRC assessments to prevent any loss of tax, but the rules limit the right to make a discovery assessment for any period if a self assessment has already been made by the taxpayer for that period.

Unless the loss of tax has been brought about carelessly or deliberately, if the information ‘discovered’ was already in the officer’s possession when the self assessment became final, HMRC have no right to make a discovery assessment.

These rules ensure that a taxpayer who has made a full disclosure in the tax return has absolute finality once the time allowed for opening an enquiry has passed. This is the case even if the tax return is subsequently found to be incorrect, unless it was incorrect because of careless or deliberate conduct. In any case where there was incomplete disclosure or careless or deliberate conduct HMRC have the power to remedy any loss of tax.

General circumstances in which discovery assessments can be made

Subject to the conditions considered below an officer of the Board is able to make a discovery assessment for a tax year if it is discovered that:

there is income or chargeable gains which ought to have been assessed, but have not been assessed, or

an assessment (including any self assessment) is, or has become insufficient, or

any relief that has been given is, or has become, excessive.

The assessment will be in the amount (or the further amount) which the officer believes will make good to the Crown the loss of tax.

An officer of the Board may also make a discovery assessment to recover any repayment of tax that should not have been made.

Restrictions on right to make discovery assessments where a self assessment has already been made for the relevant period

In any case in which a self assessment has already been made for the relevant period a discovery assessment will not be made where:

the loss of tax arose out of an error or mistake concerning the basis on which the returned tax liability was calculated, and

that basis was the generally prevailing practice at the time the tax return was made.

So, HMRC are not able to raise discovery assessments simply because they have changed their practice in relation to the treatment of some particular item.

Where the taxpayer has already delivered a tax return for the year a discovery assessment cannot be made unless either:

the loss of tax was brought about carelessly or deliberately by the taxpayer or a person acting on his behalf, or

when the time limit for issuing a notice of enquiry into the return passed, or the enquiries were completed, the officer of the Board could not have reasonably been expected, on the basis of the information made available to him, to be aware of the situation mentioned in the first paragraph under this sub-heading above.

In any case of incomplete disclosure without careless or deliberate conduct the time limit for a discovery assessment is not later than 4 years after the end of the tax year to which it relates.

In any case involving a loss of tax brought about carelessly, the time limit for making a discovery assessment is not later than 6 years after the end of tax year to which the assessment relates.

The time limit for making a discovery assessment is not later than 20 years after the end of the tax year to which it relates where the loss of tax is:

brought about deliberately by the person

attributable to a failure to notify liability, or

attributable to a tax avoidance scheme which is a notifiable arrangement or a listed or hallmarked scheme and the user of the scheme failed to disclose details to HMRC at the proper time.

?

So be careful as to what lies in your cabinet because unlike the boys in the big house, you cannot be protected. There would be a public outing of you and those closest and dearest.…!!!

Finally

Let me lighten the mood a bit…..

I was in Court this week in a ‘Jail Cell’ at The Old Court in Temple Cloud, Somerset. Don’t worry, I wasn’t in trouble. It was a family-run Grade II listed guesthouse. Try it if you fancy a change from a Hotel, Motel or Holiday Inn

Andrew James Crawford

www.fitnessindustryaccountants.com

www.facebook.com/fitnessindustryaccountants

www.twitter.com/tax4fitness

HAVE A WONDERFUL THURSDAY

See you at Fitpro

Love Rachelx

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

See our upcoming teacher training: Fitness Pilates Reformer – Online TrainingOur next online training for qualified Fitness Pilates teachers is happening onWednesday 23rd July – perfect for

What Are The Differences Between Fitness Pilates Reformer Certification and YMCA Level 3 Certificate in Instructing Studio Reformer: Group Fitness Pilates Reformer Certification Cost: £499Pre-requisites:

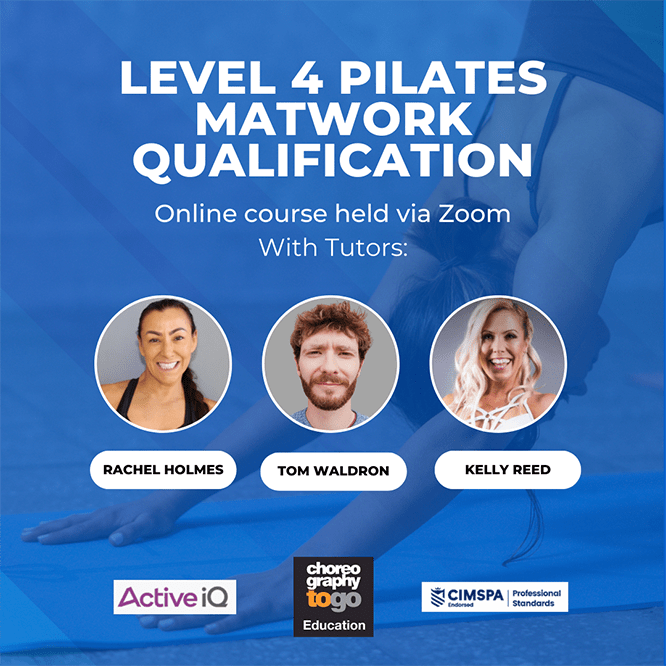

Pilates Teacher Training Courses In The UK How to Become a Qualified Pilates Teacher in the UK: Your Guide to Level 3 Training Pilates has

How to Train to Teach Pilates: Your Starter’s Guide Are you passionate about Pilates and ready to turn your love for movement into a meaningful

Reformer Pilates Teacher Training Boom at Choreographytogo It’s been an incredible week at Choreographytogo Education, with a huge surge of excitement and momentum around Reformer

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672