Fitness Pilates Hernia

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

Hey everyone – Great week for our favourite fitness girlies on the TV. Did you see Falmouth’s Top Fitness Girl & Kick Start Fat Loss Franchisee on ITV Surprise Surprise last night?

Talk about bringing a lump to your throat.

Helen Tite has been a pioneer in GP referral programmes in the South West. She has her own successful studio – The Core, she runs Kick Start Fat Loss. It was a lovely piece and if you didn’t catch it have a watch on ITV player.

PLUS

Hey everyone – Great week for our favourite fitness girlies on the TV. Did you see Falmouth’s Top Fitness Girl & Kick Start Fat Loss Franchisee on ITV Surprise Surprise last night?

Talk about bringing a lump to your throat.

Helen Tite has been a pioneer in GP referral programmes in the South West. She has her own successful studio – The Core, she runs Kick Start Fat Loss. It was a lovely piece and if you didn’t catch it have a watch on ITV player.

PLUS

Mrs Bulmer-Cooke stormed though again in week 8 of the Apprentice. Could she win????

We are all rooting for the Sunderland based Fitness Entrepreneur.

A regular contributor to the newsletter, I’ve presented with Katie, she was on my very first mentoring course & a good pal of mine and I’m so proud to see her doing so well on one of the BBC’s most watched programmes.

I flew to Dublin at the weekend to launch Kick Start Ireland, along with Laura Armada Buch. We presented the programme to 30 Instructors & I am super proud to let you know new Kick Start Classes will be opening all over the Irish Republic in 2015. This is a MASSIVE achievement for the programme & since Dublin I’ve been approached to open up franchisees in Dubai, UAE & the US. So it’s working round the clock at the moment and surviving on 3 hours of sleep.

KS EXTREME

Join us for the final KS EXTREME Workshop in London at the Reebok Club 1 – 530 It’s going to be a banger as we hit the final tour date.

Phil Richards’ Book Launch

Are you going? I am a huge Phil fan and love his presentations & I’m excited to be going to the book launch on Sunday. If you are going do say “HI” it promises to be a fab day

Music

Have you got the 100% Dance CD from Pure Energy I’m actually going to say it is my favorite mix of the YEAR! I love it so much. Make sure yoo order your copy today.

Do You offer Online programmes?

You need to check out Mr Crawfords article at the end of the newsletter.

Instructor Inspiring stories

Natsha Knight – Business & Personal Development

You may have seen Tasha’s fabulous videos on social media. She has helped hundreds of women in North London regain their figures and confidence and has empowered so many to go on to achieve fantastic goals.

Her Zumba sessions are also legendary!

She is a true original with a heart of gold and her own personal journey is incredibly positive & life-changing. Add Natsha on Facebook and you will see the positivity she spreads with every post, picture & update. She really is so inspiring.

This is Tasha’s story & how she got into becoming a Kick Start Business Owner:

I had been looking at KICKSTART FATLOSS for a while but thought no, it’s not for me – I’m not into all the clean eating – I’M A HARDCORE FITNESS TRAINER!!! I knew a bit about nutrition, well I thought I did!

I was literally on my knees, no motivation for work. I knew I needed direction and support, been self-employed for years, working for studios, dabbling in my own classes etc and always running boot camps and Zumba successfully, but I felt like I could never do it on my own. All I knew was I worked really hard long hours – I’m a grafter by nature – but was going round in circles.

Still looking at KSFL, I emailed Rachel about 5 times, after lots of excuses, lots of anxiety blah blah, I decided to just JUMP, TAKE A RISK.

Without sounding like a big old teacher’s pet I knew Rachel and her products and branding very well. I have followed her for years and attended her workshops etc. I knew without a doubt KSFL would be fantastic. The doubt was FEAR AND LACK OF SELF ESTEEM ISSUES WITH ME.

So, I joined up, nearly had a nervous breakdown – wow, lots of feelings came up as I prepared to change my mindset. This was a huge deal for me; to be honest I did not really know what I was getting into (I TEND TO JUST DO THINGS THAT FEEL RIGHT.) It was just that I trusted Rachel and I needed help and direction and KSFL just kept coming up again and again.

So I started, and did the detox!! I had already done the sugar challenge and a few other detoxes – but KSFL detox. BAM – BODY CHANGED, MINDSET, CONFIDENCE, 6 PACK, RIPPED BODY – MASSIVE CHANGES.

My other classes started to see my changes and confidence. Don’t get me wrong, I’m a born blagger. I appear confident, but I never really believed it!

Since KSFL all my other classes are super busy, I have upped my profile, I AM SUPREMELY CONFIDENT AND IT SHOWS……

This is so much more than I could have ever hoped for, I wanted everything asap when I started, but now I see it’s a slow burner and you can work at your own pace. In the beginning I felt like I had to keep up, but I understand now that you have to work at your pace. I love the support, sisterhood and the positivity of KSFL… it fits perfectly with my lifestyle.

I thought this would be a good way to make money!! IT IS, but more importantly it has nurtured, loved, supported me, grown my business and absolutely given me the confidence to stand authentically and lead a tribe of wonderful women towards their greatest good!

I have no doubt my KSFL will grow and grow and help so many people, but the beautiful thing is the growth in me as a woman and as a role model. I am so proud of myself and I adore my colleagues, I never expected so much back – I AM TRULY ABUNDANT in so many ways.

Be Inspired by Tasha and #Tashastribe

Add Tasha on Facebook – Sign up for her Newsletter http://natashaknight.co.uk/

Twitter @Tashaknightfit

Do You Want To Work in Dubai?

SPORTSJOBS4WOMEN has been created due to the culturally different locations its parent agency LEISUREFORCE trades with around the world. Especially in the Middle East, many Sports & Fitness Clubs are segregated because of Islamic views that traditionally go back many years. Therefore, this region of the world often requires that all Sports & Fitness Clubs, Spas & most educational Institutes must provide separate buildings & facilities for only females. This arrangement requires that all staff working at the Ladies-Only facilities must also be female including all the Sports & Fitness Instructors, Supervisors & up to the General Manager. These types of international fulltime vacancies for well educated & industry experienced Sports women are constantly coming in to us from locations like Qatar, Saudi Arabia, Abu Dhabi, Dubai, Oman & Bahrain plus other developing countries overseas such as In dia

SPORTSJOBS4WOMEN have recognised this growing need from an ever-increasingly Sports & Fitness enthused new audience in this wealthy part of the world. The local Arabic women living in these fast-developing Arabian countries are now realising the great benefits gained from joining a Sports & Fitness Club. There also thousands of Western women living there with their children while their husbands are employed nearby on fulltime work contracts in other industries. So we now offer to all career-focused Sports women our specialised agency service to market your career to these dedicated Ladies Only Clubs & Sports Complexes overseas. The majority of our Clients already have Sports women candidates supplied by us at their Clubs who are happily working there for many years earning tax free salaries, plus living for free. ??So be assured in the combined professional services from the new team at SPORTSJOBS4WOMEN & the long established LEISUREFORCE agency, that we will find an exciting international career move for you.

If you are interested in offering your skills to work at these Ladies Only Sports Complexes, please read on and/or call us on the number below for a friendly chat. Sports & Fitness is fast-becoming a way of life in Arabia for all women of the current generation & also those in schools right now. So this is a very special opportunity for you to become part of this exciting new era and be able to say, “You were there at the start”!

Salaries start from about £1,200/- & upto 1,800/- month per month tax free for all types of Sports & Fitness Coaches & increase upto £3,000/- month tax free for experienced Club General Managers. This salary is almost all “spending money” because you also get free accommodation & transport.??YOUR POTENTIAL EMPLOYER Our clients are UK and internationally managed large Sports Club groups, 5 star international Hotels, large Resorts & private Spas. Positions are NOT holiday jobs, but fulltime good career moves & you will often be joining other candidates placed by us at the same club or in the same city. For international positions, your Manager may also be a UK / European woman placed by us.

We are looking for experienced group exercise instructors who are looking for an opportunity to work abroad and learn about a new culture. If you are interested in registering with us all you need to do is send us a short clip of you teaching a class, any class as long as you show the intro and the warm up and about 10 minutes of the main part of the club along with your CV. We also have vacancies for Female Fitness Managers and Full time Personal Trainers. All we require for these roles are your up to date CV.

EMAIL:justine@sportsjobs4women.net?FIND YOUR IDEALJOB AT:www.sportsjobs4women.net

GET IN TOUCH AND START YOUR NEW JOURNEY TODAY

From Cradle to The Grave

Andrew Crawford

This week I have been inundated with the new VAT issue which will affect all of you who have online businesses. (With customers abroad).

I was going to write a laymans article about it tonight but I am totally shattered.

Look out for it on my site, you will find it on this page…(Give me a couple of days).

http://www.fitnessindustryaccountants.com/tipsontax.htm

Why am I shattered?

Well, since Sunday I have been in Brighton….all for business ‘onest guv…!!

Then yesterday I was in Essex and drove back late tonight so I missed TV Apprentice tonight so don’t know how our Katie did?

Hold on….hold on…

Andrew…

What has Brighton got to do with Accountancy & Tax??

As I mention, I was there on business. The business was dealing with the ‘Death Estate’ of an elderly lady who recently died including the calculation of the deadly Inheritance Tax.

I relearnt so much in those couple of days ..like….LIVE your life..!!!!

You must be aware that not only are you taxed in life but you are also taxed after you have died but whoever you leave behind will have to pay the tax. And deal with all the paperwork, your secret diaries, notes, photos, anything that you have hidden beyond the sight of wandering eyes…!!

Remember EVERYTHING in your name over £325,000 will be taxed at 40%. ……EVERYTHING…..(your car, cash, savings, shares, bonds, furniture, assets, property even those abroad, gifts you have made in the last 7 years !!!)…Anything that has a value..!!

You all know the 7 year rule. Learn it..!! Give then wait 7 years this giving then ‘falls outside’ the IHT calculation.

Here are the IHT rates…

http://www.fitnessindustryaccountants.com/ard/detail_doc.asp?ID=638120&AID=1987&SID=11&FID=37232

Basically, if you make a gift to someone and live for 7 years after that gift, the value of that gift will not be counted as part of your ‘Death Estate’

Some important gift types come into play, you may or may not have heard of them, so I summarise them here.

Exempt transfers – These are gifts with specific exemptions, for example a gift to your spouse.

Potentially Exempt Transfers (PETs) – This gift is initially treated as exempt but becomes chargeable if you die within 7 years. (That is why it’s called ‘Potential’)

Chargeable Lifetime Transfers (CLTs) – A gift you make in your lifetime and IHT is paid when the gift is made. For example if you give a gift to a trust.

I have noticed…(hope you have too) amongst other things, that the nil rate band, that is the amount of value at which the value of all your assets can be before the 40% Kicks in, which is £325,000 at the moment, has been artificially kept low…..why?….to TRAP everyone…….allegedly.

Let’s see if it changes in the next election…!!!

OK Andrew…… Is there a way to avoid the Death Tax?

Why…Yes of course…and I suspect you want me to reveal some tricks here??

Firstly make sure you have a tax efficient will. If you die without making a will (intestate) and you have no children a large proportion of your estate will go to…………..The Government….and I know you would want to bolster up thier already bursting coffers…tee hee

Oh….and did you know you can change a will AFTER your death, called ‘Deed Of Variation’.

Secondly…….Transfer your assets…..again for those not paying attention……Transfer your assets…EVERY 7 years….(diamond)

Even though all transfers and gifts to your spouse are exempt, this will raise the value of their estate. So when they die, the IHT will be high.

Spend…!!!!!

Thirdly, use Trusts to shelter your gifts.

There are 3 types

Accumulation & Maintenance Trust

Interest in Possession Trusts

Discretionary Trusts

Next….. ‘Gifts Out Of Income’, this is where if you make any amount of gift out of your income, especially large gifts, it will cease to be part of your estate from the moment you have made that gift….

However…………as with all things, there are conditions.

The gift should be part of your ‘normal’ expenditure (so give this gift EACH year).

After making the gift, it will not affect your standard of living.

That’s it……….

Finally

The new VAT I suspect it to ensure that non VAT registered businesses become VAT registered. If and only if you have an online business supplying customers from abroad.

It was mentioned in September in my ‘News for Business’ section here…

http://www.fitnessindustryaccountants.com/ard/enews_article.asp?ID=5598&AID=1987&CID=1

These people are clever with introducing tax. There’s no escaping.

We are taxed ‘From Cradle to The Grave’

Andrew James Crawford

www.fitnessindustryaccountants.com

www.facebook.com/fitnessindustryaccountants

www.twitter.com/tax4fitness

Have a wonderful Day

Rachel x

Mrs Bulmer-Cooke stormed though again in week 8 of the Apprentice. Could she win????

We are all rooting for the Sunderland based Fitness Entrepreneur.

A regular contributor to the newsletter, I’ve presented with Katie, she was on my very first mentoring course & a good pal of mine and I’m so proud to see her doing so well on one of the BBC’s most watched programmes.

I flew to Dublin at the weekend to launch Kick Start Ireland, along with Laura Armada Buch. We presented the programme to 30 Instructors & I am super proud to let you know new Kick Start Classes will be opening all over the Irish Republic in 2015. This is a MASSIVE achievement for the programme & since Dublin I’ve been approached to open up franchisees in Dubai, UAE & the US. So it’s working round the clock at the moment and surviving on 3 hours of sleep.

KS EXTREME

Join us for the final KS EXTREME Workshop in London at the Reebok Club 1 – 530 It’s going to be a banger as we hit the final tour date.

Phil Richards’ Book Launch

Are you going? I am a huge Phil fan and love his presentations & I’m excited to be going to the book launch on Sunday. If you are going do say “HI” it promises to be a fab day

Music

Have you got the 100% Dance CD from Pure Energy I’m actually going to say it is my favorite mix of the YEAR! I love it so much. Make sure yoo order your copy today.

Do You offer Online programmes?

You need to check out Mr Crawfords article at the end of the newsletter.

Instructor Inspiring stories

Natsha Knight – Business & Personal Development

You may have seen Tasha’s fabulous videos on social media. She has helped hundreds of women in North London regain their figures and confidence and has empowered so many to go on to achieve fantastic goals.

Her Zumba sessions are also legendary!

She is a true original with a heart of gold and her own personal journey is incredibly positive & life-changing. Add Natsha on Facebook and you will see the positivity she spreads with every post, picture & update. She really is so inspiring.

This is Tasha’s story & how she got into becoming a Kick Start Business Owner:

I had been looking at KICKSTART FATLOSS for a while but thought no, it’s not for me – I’m not into all the clean eating – I’M A HARDCORE FITNESS TRAINER!!! I knew a bit about nutrition, well I thought I did!

I was literally on my knees, no motivation for work. I knew I needed direction and support, been self-employed for years, working for studios, dabbling in my own classes etc and always running boot camps and Zumba successfully, but I felt like I could never do it on my own. All I knew was I worked really hard long hours – I’m a grafter by nature – but was going round in circles.

Still looking at KSFL, I emailed Rachel about 5 times, after lots of excuses, lots of anxiety blah blah, I decided to just JUMP, TAKE A RISK.

Without sounding like a big old teacher’s pet I knew Rachel and her products and branding very well. I have followed her for years and attended her workshops etc. I knew without a doubt KSFL would be fantastic. The doubt was FEAR AND LACK OF SELF ESTEEM ISSUES WITH ME.

So, I joined up, nearly had a nervous breakdown – wow, lots of feelings came up as I prepared to change my mindset. This was a huge deal for me; to be honest I did not really know what I was getting into (I TEND TO JUST DO THINGS THAT FEEL RIGHT.) It was just that I trusted Rachel and I needed help and direction and KSFL just kept coming up again and again.

So I started, and did the detox!! I had already done the sugar challenge and a few other detoxes – but KSFL detox. BAM – BODY CHANGED, MINDSET, CONFIDENCE, 6 PACK, RIPPED BODY – MASSIVE CHANGES.

My other classes started to see my changes and confidence. Don’t get me wrong, I’m a born blagger. I appear confident, but I never really believed it!

Since KSFL all my other classes are super busy, I have upped my profile, I AM SUPREMELY CONFIDENT AND IT SHOWS……

This is so much more than I could have ever hoped for, I wanted everything asap when I started, but now I see it’s a slow burner and you can work at your own pace. In the beginning I felt like I had to keep up, but I understand now that you have to work at your pace. I love the support, sisterhood and the positivity of KSFL… it fits perfectly with my lifestyle.

I thought this would be a good way to make money!! IT IS, but more importantly it has nurtured, loved, supported me, grown my business and absolutely given me the confidence to stand authentically and lead a tribe of wonderful women towards their greatest good!

I have no doubt my KSFL will grow and grow and help so many people, but the beautiful thing is the growth in me as a woman and as a role model. I am so proud of myself and I adore my colleagues, I never expected so much back – I AM TRULY ABUNDANT in so many ways.

Be Inspired by Tasha and #Tashastribe

Add Tasha on Facebook – Sign up for her Newsletter http://natashaknight.co.uk/

Twitter @Tashaknightfit

Do You Want To Work in Dubai?

SPORTSJOBS4WOMEN has been created due to the culturally different locations its parent agency LEISUREFORCE trades with around the world. Especially in the Middle East, many Sports & Fitness Clubs are segregated because of Islamic views that traditionally go back many years. Therefore, this region of the world often requires that all Sports & Fitness Clubs, Spas & most educational Institutes must provide separate buildings & facilities for only females. This arrangement requires that all staff working at the Ladies-Only facilities must also be female including all the Sports & Fitness Instructors, Supervisors & up to the General Manager. These types of international fulltime vacancies for well educated & industry experienced Sports women are constantly coming in to us from locations like Qatar, Saudi Arabia, Abu Dhabi, Dubai, Oman & Bahrain plus other developing countries overseas such as In dia

SPORTSJOBS4WOMEN have recognised this growing need from an ever-increasingly Sports & Fitness enthused new audience in this wealthy part of the world. The local Arabic women living in these fast-developing Arabian countries are now realising the great benefits gained from joining a Sports & Fitness Club. There also thousands of Western women living there with their children while their husbands are employed nearby on fulltime work contracts in other industries. So we now offer to all career-focused Sports women our specialised agency service to market your career to these dedicated Ladies Only Clubs & Sports Complexes overseas. The majority of our Clients already have Sports women candidates supplied by us at their Clubs who are happily working there for many years earning tax free salaries, plus living for free. ??So be assured in the combined professional services from the new team at SPORTSJOBS4WOMEN & the long established LEISUREFORCE agency, that we will find an exciting international career move for you.

If you are interested in offering your skills to work at these Ladies Only Sports Complexes, please read on and/or call us on the number below for a friendly chat. Sports & Fitness is fast-becoming a way of life in Arabia for all women of the current generation & also those in schools right now. So this is a very special opportunity for you to become part of this exciting new era and be able to say, “You were there at the start”!

Salaries start from about £1,200/- & upto 1,800/- month per month tax free for all types of Sports & Fitness Coaches & increase upto £3,000/- month tax free for experienced Club General Managers. This salary is almost all “spending money” because you also get free accommodation & transport.??YOUR POTENTIAL EMPLOYER Our clients are UK and internationally managed large Sports Club groups, 5 star international Hotels, large Resorts & private Spas. Positions are NOT holiday jobs, but fulltime good career moves & you will often be joining other candidates placed by us at the same club or in the same city. For international positions, your Manager may also be a UK / European woman placed by us.

We are looking for experienced group exercise instructors who are looking for an opportunity to work abroad and learn about a new culture. If you are interested in registering with us all you need to do is send us a short clip of you teaching a class, any class as long as you show the intro and the warm up and about 10 minutes of the main part of the club along with your CV. We also have vacancies for Female Fitness Managers and Full time Personal Trainers. All we require for these roles are your up to date CV.

EMAIL:justine@sportsjobs4women.net?FIND YOUR IDEALJOB AT:www.sportsjobs4women.net

GET IN TOUCH AND START YOUR NEW JOURNEY TODAY

From Cradle to The Grave

Andrew Crawford

This week I have been inundated with the new VAT issue which will affect all of you who have online businesses. (With customers abroad).

I was going to write a laymans article about it tonight but I am totally shattered.

Look out for it on my site, you will find it on this page…(Give me a couple of days).

http://www.fitnessindustryaccountants.com/tipsontax.htm

Why am I shattered?

Well, since Sunday I have been in Brighton….all for business ‘onest guv…!!

Then yesterday I was in Essex and drove back late tonight so I missed TV Apprentice tonight so don’t know how our Katie did?

Hold on….hold on…

Andrew…

What has Brighton got to do with Accountancy & Tax??

As I mention, I was there on business. The business was dealing with the ‘Death Estate’ of an elderly lady who recently died including the calculation of the deadly Inheritance Tax.

I relearnt so much in those couple of days ..like….LIVE your life..!!!!

You must be aware that not only are you taxed in life but you are also taxed after you have died but whoever you leave behind will have to pay the tax. And deal with all the paperwork, your secret diaries, notes, photos, anything that you have hidden beyond the sight of wandering eyes…!!

Remember EVERYTHING in your name over £325,000 will be taxed at 40%. ……EVERYTHING…..(your car, cash, savings, shares, bonds, furniture, assets, property even those abroad, gifts you have made in the last 7 years !!!)…Anything that has a value..!!

You all know the 7 year rule. Learn it..!! Give then wait 7 years this giving then ‘falls outside’ the IHT calculation.

Here are the IHT rates…

http://www.fitnessindustryaccountants.com/ard/detail_doc.asp?ID=638120&AID=1987&SID=11&FID=37232

Basically, if you make a gift to someone and live for 7 years after that gift, the value of that gift will not be counted as part of your ‘Death Estate’

Some important gift types come into play, you may or may not have heard of them, so I summarise them here.

Exempt transfers – These are gifts with specific exemptions, for example a gift to your spouse.

Potentially Exempt Transfers (PETs) – This gift is initially treated as exempt but becomes chargeable if you die within 7 years. (That is why it’s called ‘Potential’)

Chargeable Lifetime Transfers (CLTs) – A gift you make in your lifetime and IHT is paid when the gift is made. For example if you give a gift to a trust.

I have noticed…(hope you have too) amongst other things, that the nil rate band, that is the amount of value at which the value of all your assets can be before the 40% Kicks in, which is £325,000 at the moment, has been artificially kept low…..why?….to TRAP everyone…….allegedly.

Let’s see if it changes in the next election…!!!

OK Andrew…… Is there a way to avoid the Death Tax?

Why…Yes of course…and I suspect you want me to reveal some tricks here??

Firstly make sure you have a tax efficient will. If you die without making a will (intestate) and you have no children a large proportion of your estate will go to…………..The Government….and I know you would want to bolster up thier already bursting coffers…tee hee

Oh….and did you know you can change a will AFTER your death, called ‘Deed Of Variation’.

Secondly…….Transfer your assets…..again for those not paying attention……Transfer your assets…EVERY 7 years….(diamond)

Even though all transfers and gifts to your spouse are exempt, this will raise the value of their estate. So when they die, the IHT will be high.

Spend…!!!!!

Thirdly, use Trusts to shelter your gifts.

There are 3 types

Accumulation & Maintenance Trust

Interest in Possession Trusts

Discretionary Trusts

Next….. ‘Gifts Out Of Income’, this is where if you make any amount of gift out of your income, especially large gifts, it will cease to be part of your estate from the moment you have made that gift….

However…………as with all things, there are conditions.

The gift should be part of your ‘normal’ expenditure (so give this gift EACH year).

After making the gift, it will not affect your standard of living.

That’s it……….

Finally

The new VAT I suspect it to ensure that non VAT registered businesses become VAT registered. If and only if you have an online business supplying customers from abroad.

It was mentioned in September in my ‘News for Business’ section here…

http://www.fitnessindustryaccountants.com/ard/enews_article.asp?ID=5598&AID=1987&CID=1

These people are clever with introducing tax. There’s no escaping.

We are taxed ‘From Cradle to The Grave’

Andrew James Crawford

www.fitnessindustryaccountants.com

www.facebook.com/fitnessindustryaccountants

www.twitter.com/tax4fitness

Have a wonderful Day

Rachel x

All over the UK, we’re seeing Pilates and Reformer studios popping up at an incredible pace! It’s a fascinating landscape right now, as many boutique

See our upcoming teacher training: Fitness Pilates Reformer – Online TrainingOur next online training for qualified Fitness Pilates teachers is happening onWednesday 23rd July – perfect for

What Are The Differences Between Fitness Pilates Reformer Certification and YMCA Level 3 Certificate in Instructing Studio Reformer: Group Fitness Pilates Reformer Certification Cost: £499Pre-requisites:

Pilates Teacher Training Courses In The UK How to Become a Qualified Pilates Teacher in the UK: Your Guide to Level 3 Training Pilates has

How to Train to Teach Pilates: Your Starter’s Guide Are you passionate about Pilates and ready to turn your love for movement into a meaningful

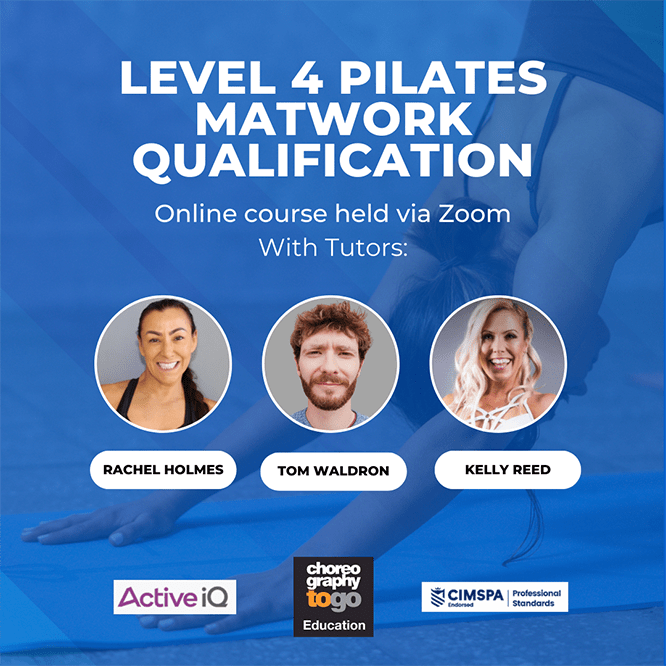

Reformer Pilates Teacher Training Boom at Choreographytogo It’s been an incredible week at Choreographytogo Education, with a huge surge of excitement and momentum around Reformer

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672