Choreographytogo offers of the month end today

Our Choreographytogo offers of the month end midnight tonight (30th June 2025) this is your last chance to grab these deals: 🪑 Sit Fitness Workshop

It’s here. 2015 is right on top

of us faster than we would ever believe and suddenly

the pressure is on to build your business, improve on everything you did last year and do more, more, more.

The word of the week is FOCUS.

I’m sitting at my desk surrounded by projects and papers

and notes and books to read and phone calls to make and my iphone’s to do list is growing longer by the second.

It’s so easy to get swamped and carried away,

so my priority is to FOCUS.

And only do the daily things that really need to

get done and delegate the rest.

I’m setting a priority goal for the day and only doing

tasks that bring towards that priority goal…

I’m trying hard not to get distracted!

Have you made a new 12 months goals list?

I LOVE a list!

Especially a ma-HOU-Sive list

with huge crazy goals…why not?

Why think small?

Make a list of 10 BIG BIG Goals for 2015.

10 Goals that will push you so that when you hit them you will feel FANTASTIC & totally accomplished.

I can feel it in my bones that Health & Fitness will

really be massive in 2015. Its getting bigger all the time.

It’s taken us a long time to get here.

In my 27 years of teaching I’ve never

felt so many people getting interested in health &fitness.

You can see the buzz on social media,

people want to get fit, they are interested in going

to a class and trying something new. We need to ensure that what we offer is marketed at the right people.

Think about launching some

new sessions, new titles, new content, new music.

Great creative.

Plan some innovative freestyle classes.

Even if you are revamping classes that you have

taught before, give your timetable a new lease of life and make it exciting for people to come out of doors on cold nights.

Fast Facebook Fitness Marketing by Rachel

Facebook is an amazing way to get your message out but you have to be consistent and have a strategy.

The news feed moves so fast you need to be updating your status a minimum of twice a day at THE very minimum

I’m also a huge iphone fan as you can take pics, make quick videos of your classes, interview your class members in seconds and upload these all to your Facebook.

It takes zero effort and will certainly make your page stand out so much more. Always remember fitness is about people and personalities. People come to your classes because they like YOU. They click with YOU so film that, take funky pictures & quick videos and get it up on your Facebook every day.

Here are my current top Facebook Fitness Marketing Tips

1: Make your status updates fun, interesting and informative. Have a laugh and you will get tons more feedback.

2:You are not just “SELLING” your classes you are engaging with and getting to know the people who follow you. Ask questions, talk to people, that is why it’s called SOCIAL media. YOu are selling YOU. YOU are your brand.

3:Post pictures with funky slogans. There are loads of wicked apps where you can take your pictures and add text. I use INSTACOLLAGE but I also love using iphoto & imovie and make most of my slogan pics in INSTACOLLAGE.

4: Film snippets of your classes and interview your most verbal class members. Get some one to hold your phone while you do a quick 2 minute interview and get it up online. You are giving your Facebook some real personality then.

5:Film 1 minute meal ideas, 1minute workouts to do at home, 1 minute fit tips. The more you do and upload the easier it becomes, but do it regularly not just once a blue moon. You will get more confident in front of the camera the more you do. Film in one take on your smart phone and upload in minutes.

6:Facebook Events – Make sure you update your events with your classes, courses, workshops and invite your friends.

People need to see things at least 7 times before they decide to book or come along. I can’t stress enough consistency is the key

Marketers use the Rule of Seven. Prospects must see or hear your message seven times before they consider buying.

The Instructors who are most successful with Social Media are the ones who post consistently good content that is interesting and fun and endears me to that person.

You feel like you know them, they have fun on social media and you always think “I’ll just have a quick look at what *********** is up to” Because you know it will be inspiring and informative.

Does that help you with what to post on Facebook?

Tweet me @RachelHolmes or facebook.com/Choreographytogo

YOUTUBE The Second Biggest Search Engine after Google

Have you got a YOUTUBE Channel?

No then get one up and running asap. The more Youtube videos you put up the quicker you will get to the top of google and help more traffic to your website and potential customers to find you.

1. Call your channel your name or business name whichever you want to promote. I am Rachel Holmes TV.

2. Film regular VLOGs – You could be talking about Fitness Tips, Diet information, Doing Cookery, Shopping for Fat Loss foods in Morrisons, Going for a walk whilst talking … anything pertinent to your target market.

3. Film 10 minute workouts and promote them in your newsletters.

4. Film clips of your classes.

5.Film testimonials of your class members and clients.

The trick with all social media is consistency and to keep updating your channels keeping your content fresh and exciting.

Enthusiasm & Passion Is the Key

In November Laura Armarda Buch took on the Kick Start Fat Loss

Country License Franchise.

And this week she totally smashed it with sheer enthusiasm and passion.

She started 2 new Kick Start classes this week and has record numbers booked. 45 on Tuesday evening and 33 on Tuesday morning,

which is unheard of.

Laura has been trying for 3 years to fill morning classes and nothing has got of the ground until now.

But Laura is thinking BIG she took out a huge BILLBOARD Advert in the middle of town and then the phone never stopped ringing.

The morning class booked out in 3 hours.

She had to get helpers to assist her with all the enquiries and bookings

With the huge competition from the traditional slimming clubs she needed to make a statement and what a statement she made.

And, if you look at her social media,her excited postings on Facebook you can literally “feel” the passion and enthusiasm in her posts.

It is intoxicating and you can see people getting really excited about it, wanting to know more and get involved.

You can literally FEEL that energy though the screen.

I could imagine her excitedly typing away so fast on her iphone getting the info out about her new KSFL clubs.

When you look at someone’s social media & you REALLY can feel the energy and steam coming from the page when there is serious passion involved.

Laura has firmly put Kick Start on the Irish map.

In less than 2 months we have 31 new Franchisees opening up.

Before I went to Ireland everyone said I would be wasting

my time, the Irish are not interested in health,

the recession is bad & they will not pay for Kick Start,

even the owner of a major chain said to me

“Rachel, there is no way it will work in Ireland, its a different mind set, different culture”

Thank GOODNESS we didn’t listen.

It’s the enthusiasm and passion that is so apparent

everyone wants to sign up.

Laura is saying to the world

“I wholeheartedly believe in this and I’m going to make it work”

So it works and business soars.

Laura’s enthusiasm has lit a fire under more

Instructors who are now coming on the KSFL journey.

If you believe in something 100% and you have serious

passion and enthusiasm you can move mountains & make it successful.

If you are passionate about fatloss and fitness

and you are teaching classes in the community then get in touch.

Kick Start Fat Loss is moving so fast, with some incredible opportunities.

You need enthusiasm and passion and love people and I can help you with the rest.

Be enthusiastic and don’t be afraid to show it in your articles, videos, Facebook postings and of course, in person, it really is the key.

If you would like to listen to the LIVE webinar replay of last weeks

“Everything YOu Need to Know About

Becoming a Kick Star Fat LOss Franchisee”

Facebook message me ASAP for the link

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Calling All Fitpros, Bootcamp Instructors, PT”s and Entrepreneurs in Shropshire. Danni Evans is holding a special invite only Kick Start event on 1st Feb I will be doing a talk so if you would like to attend contact Danni via Facebook ASAP

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Roll on 2016……!!!

By Andrew Crawford

A prosperous 2015 to you and yours……….Where did 2014 go??

They say that as you get older, time goes faster….!! Lucky I stopped my age at 44…!!

So…….What did you achieve ? What were you working on? Did anyone STEAL your dream? What next? Where to? How far? Why?……………..Why not?

Go on ……be a Rebel…there ain’t no rules. Be The Best You…!!

2014 will never come back again, here we are on the doorsteps of 2015 looking forward to 2016……..

You are the Master of Your Destiny..You Decide….in fact…when you decide to decide….you’ll be on your way.

Someone please tell me…what the dickens happened over there in Paris with those Cartoonists??

Ok ..Ok….moving swiftly on…

This made me chuckle for a long time last week…and the comments that went with it….Lord Have Mercy…. I’ll leave it with you to ponder…Here was the talking point.

A Black James Bond.

Easy Tiger & Tigeresses….!!

So I thought….What about this one then??

A Black Tarzan. Or….. A Black Jesus…..Heaven forbid..!!

For the children who are not born yet, we could easily do the switch and they wouldn’t have a Scobby Doo…!!

Then my mind went into overdrive…

Imagine this…

Supposing the original inhabitants of USA, Australia, New Zealand & Tasmania were Caucasian (White)..oh…and let’s chuck in South Africa…

Then the Black man, Indian man, Aborigine , The Maoris and Tasmanian Aborigines ‘discovered’ those countries, went there and massacred then started to exterminate and eliminate all, took over the furtile land using force, violence and multiple killings….

Food for thought….Don’t you think?

Oh…Andrew James Crawford….!!!!

Have you lost your mind? What has all this ‘old news’ about the ‘treatment’ got to do with Accountancy & Tax???

Well….

Although it’s old news it was all to do with the treatment.

So….I’ve been looking at the treatment albeit the Tax Treatment and Tax Relief of Pensions as we become the ‘old news’ whilst getting older and creating our own history. So I wanted to spell it out in black and white.

Pensions – changes to access of pension funds

Pensioners will have complete freedom to draw down as much or as little of their pension pot as they want, anytime they want’. Some of changes have already taken effect but the big changes will come into effect on 6 April 2015 for individuals who have money purchase pension funds.

The tax consequences of the changes are contained in the Taxation of Pensions Bill which is currently going through Parliament.

Under the current system, there is some flexibility in accessing a pension fund from the age of 55:

tax free lump sum of 25% of fund value

purchase of an annuity with the remaining fund, or

income drawdown.

For income drawdown there are limits, in most cases, on how much people can draw each year.

An annuity is taxable income in the year of receipt. Similarly any monies received from the income drawdown fund are taxable income in the year of receipt.

From 6 April 2015, the ability to take a tax free lump sum and a lifetime annuity remain but some of the current restrictions on a lifetime annuity will be removed to allow more choice on the type of annuity taken out.

The rules involving drawdown will change. There will be total freedom to access a pension fund from the age of 55.

It is proposed that access to the fund will be achieved in one of two ways:

allocation of a pension fund (or part of a pension fund) into a ‘flexi-access drawdown account’ from which any amount can be taken over whatever period the person decides

taking a single or series of lump sums from a pension fund (known as an ‘uncrystallised funds pension lump sum’).

When an allocation of funds into a flexi-access account is made the member typically will take the opportunity of taking a tax free lump sum from the fund (as under current rules).

The person will then decide how much or how little to take from the flexi-access account. Any amounts that are taken will count as taxable income in the year of receipt.

Access to some or all of a pension fund without first allocating to a flexi-access account can be achieved by taking an uncrystallised funds pension lump sum.

The tax effect will be:

25% is tax free

the remainder is taxable as income.

Comment?The fundamental tax planning point arising from the changes is self-evident. A person should decide when to access funds depending upon their other income in each tax year.

Pensions – changes to tax relief for pension contributions

The government is alive to the possibility of people taking advantage of the new flexibilities by ‘recycling’ their earned income into pensions and then immediately taking out amounts from their pension funds. Without further controls being put into place an individual would obtain tax relief on the pension contributions but only be taxed on 75% of the funds immediately withdrawn.

Currently an ‘annual allowance’ sets the maximum amount of tax efficient contributions. The annual allowance is £40,000 (but there may be more allowance available if the maximum allowance has not been utilised in the previous years).

Under the proposed rules from 6 April 2015, the annual allowance for contributions to money purchase schemes will be reduced to £10,000 in certain scenarios. There will be no carry forward of any of the £10,000 to a later year if it is not used in the year.

The main scenarios in which the reduced annual allowance is triggered is if:

any income is taken from a flexi-access drawdown account, or

an uncrystallised funds pension lump sum is received.

However just taking a tax-free lump sum when funds are transferred into a flexi-access account will not trigger the £10,000 rule.

Finally

Where is all the good news??

It’s still coming….!!! Roll on 2016….!!

Andrew James Crawford

www.fitnessindustryaccountants.com

www.facebook.com/fitnessindustryaccountants

www.twitter.com/tax4fitness

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Have a wonderful Day

Love Rachel xxx

Tweet me @RachelHolmes

Instagram RachelLHolmes

Facebook.com/Choreographytogo

Facebook.com/KickStartFatLoss

Facebook.com/FitnessPilates

Our Choreographytogo offers of the month end midnight tonight (30th June 2025) this is your last chance to grab these deals: 🪑 Sit Fitness Workshop

WOW! Record Turnout for Last Week’s Fitness Pilates Reformer Certification! What an incredible day!We had a record number of learners attend this week’s Fitness Pilates

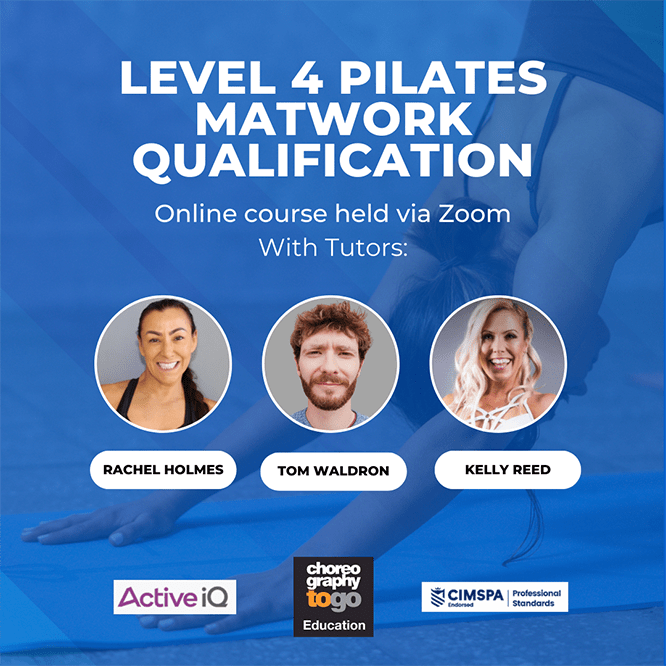

Quick Facts About Our Level 3 Pilates Diploma – Start Your Teaching Journey This July Are you thinking about becoming a fully qualified Pilates Instructor?

See our upcoming teacher training: Fitness Pilates Reformer – Online TrainingOur next online training for qualified Fitness Pilates teachers is happening onWednesday 23rd July – perfect for

Fitness Pilates Newsletter 29th June 2025 It’s been a busy week here at Choreographytogo! We successfully launched the Level 3 Reformer Course live in Derby

PRESS RELEASEFor Immediate Release Groundbreaking First Live YMCA Level 3 Reformer Qualification Delivered at Bloom Studios, Derby Earlier this week, Choreographytogo proudly delivered the very

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672